Your Wording reverse charge vat invoice example images are available in this site. Wording reverse charge vat invoice example are a topic that is being searched for and liked by netizens today. You can Find and Download the Wording reverse charge vat invoice example files here. Get all royalty-free photos and vectors.

If you’re looking for wording reverse charge vat invoice example images information related to the wording reverse charge vat invoice example keyword, you have come to the ideal site. Our website frequently gives you hints for seeing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

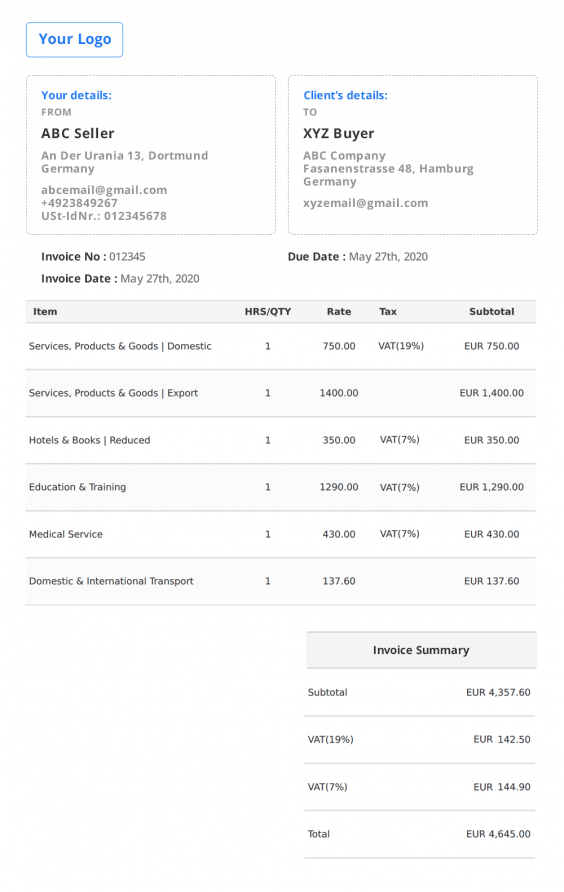

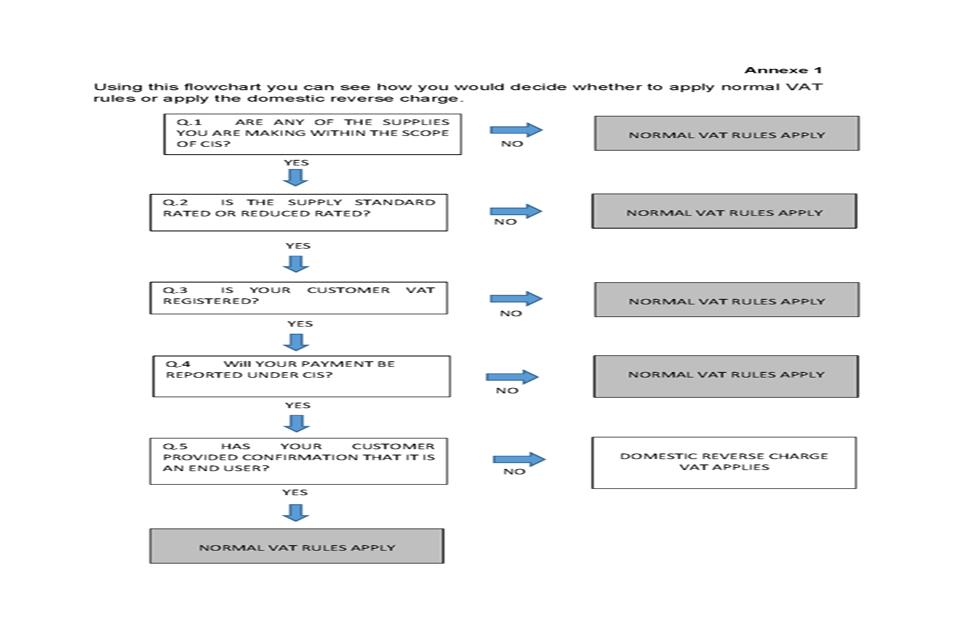

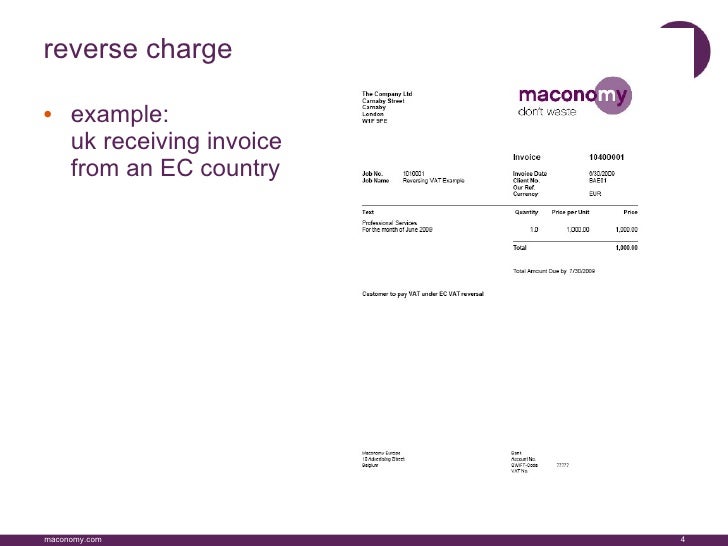

Wording Reverse Charge Vat Invoice Example. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above. An example of wording that could be used on the invoice is. In the case of a reverse charge the customers VAT number and a notation that a reverse charge applies. 2172021 45402 PM.

Domestic Reverse Charge Vat What Does This Mean For You Eque2 From eque2.co.uk

Domestic Reverse Charge Vat What Does This Mean For You Eque2 From eque2.co.uk

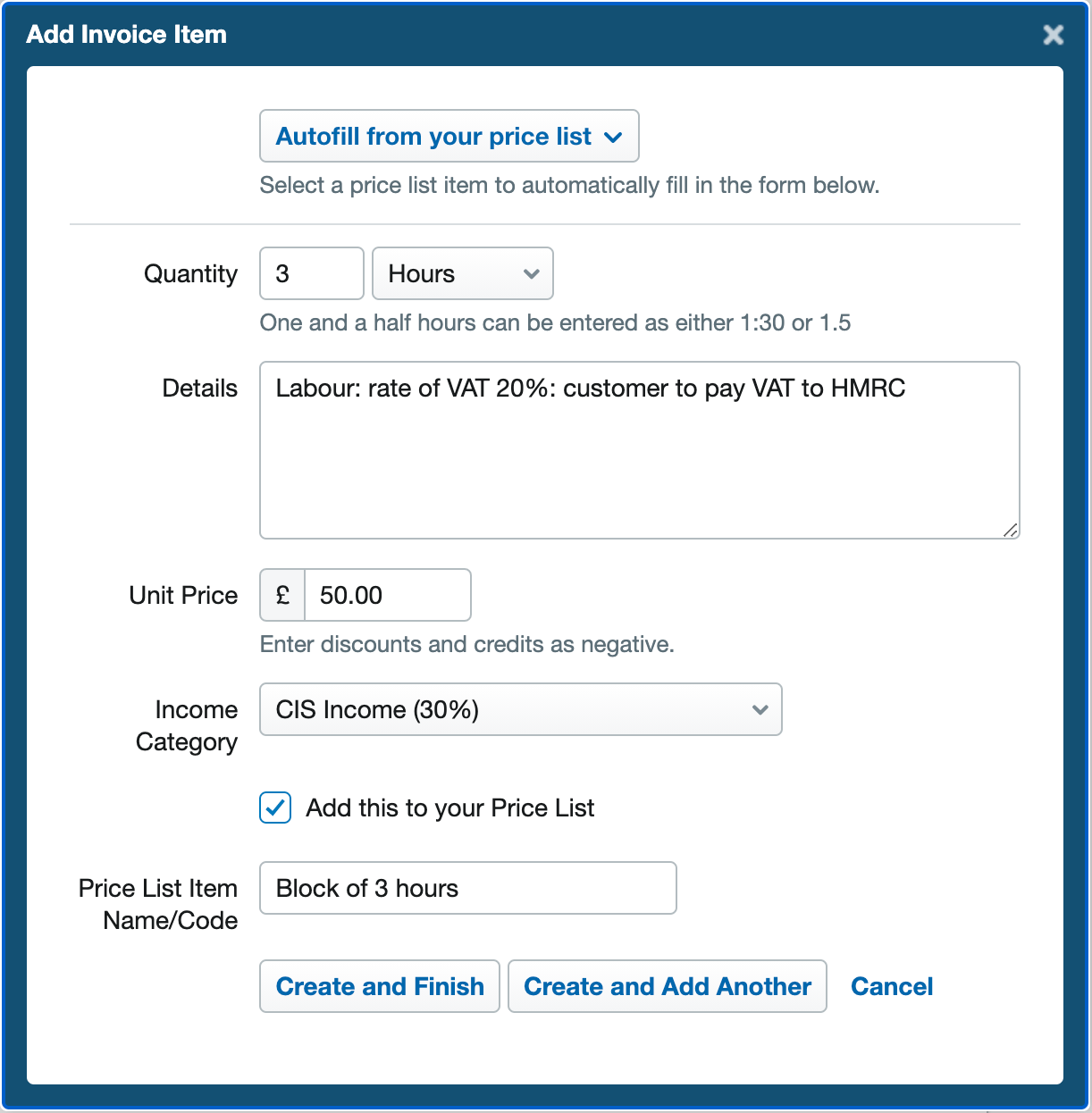

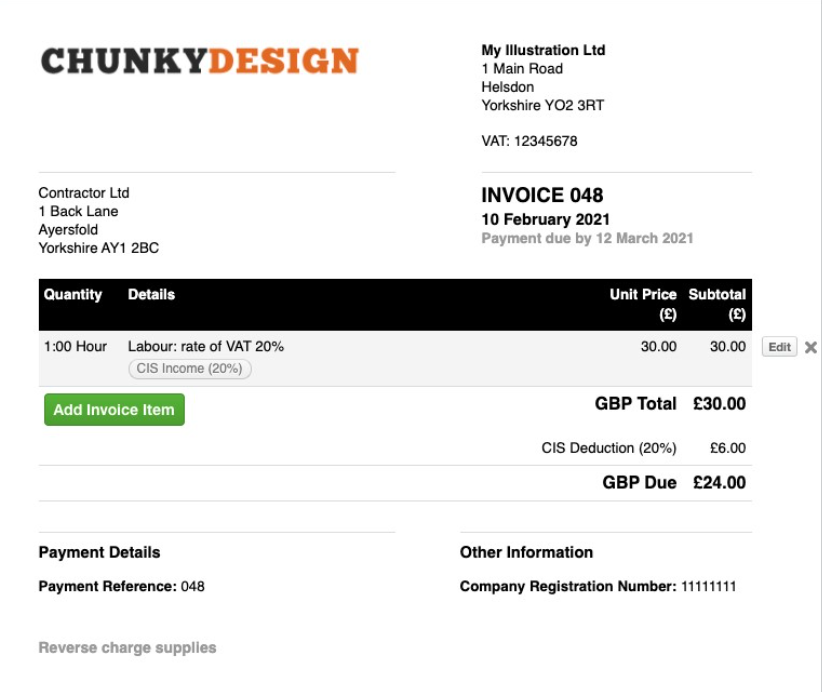

According to the reverse-charge regulation tax liability transfers to the recipient of services. Here are some examples of wording that meet the legal requirement. Feel free to check each template one by one. Below youll find a sample domestic reverse charge VAT invoice. To demonstrate which items are subject to reverse charging you can use an invoice template which itemises all labour and materials and add the Item Tax Type merge field jobMaterialtax_rate as a column in your invoices table formatting to display the name of the tax rate applied next to each individual line item. Hi Paula Thanks for using Sage City.

In addition you must have the VAT identification number checked before you act.

As a general rule businesses charge VAT on supplies and deduct VAT on purchases. The Value-Added Tax VAT invoice must show. If you use Excel to create your invoices we have provided some free invoice templates below. The suppliers full name address and registration number. As part of this when you use a reverse charge tax code the invoice or credit note you produce in should include the text shown in the below example. In addition you must have the VAT identification number checked before you act.

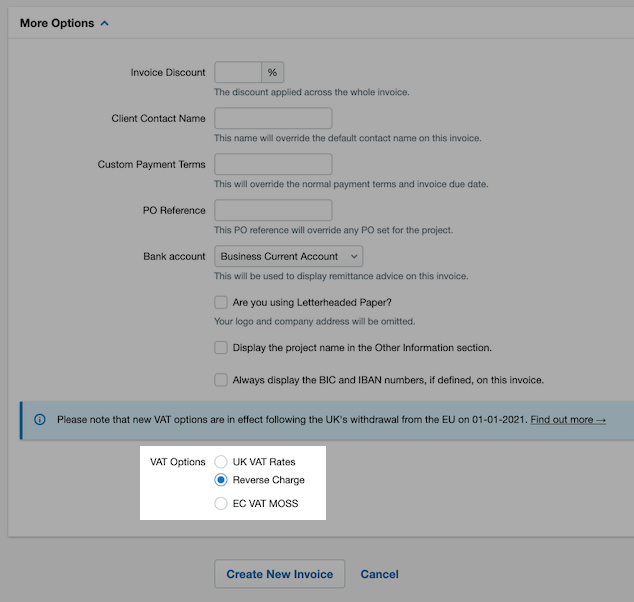

Source: support.freeagent.com

Source: support.freeagent.com

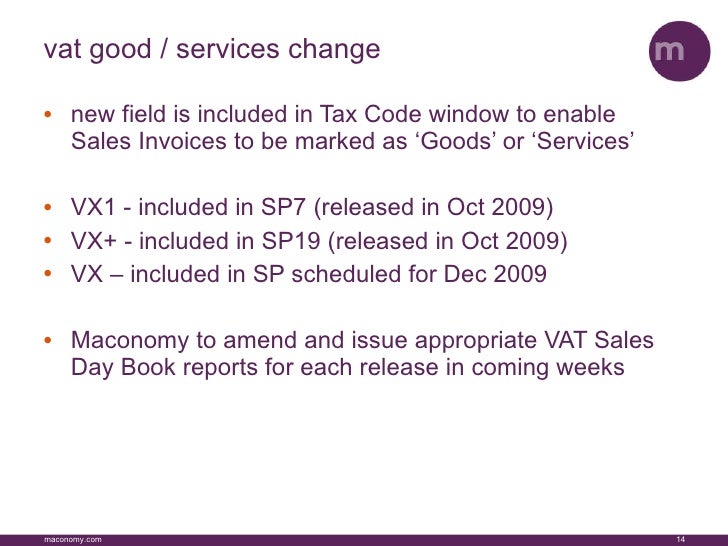

Under the reverse-charge procedure the words Reverse charge. Example of a reverse charge invoice for one contract with different VAT rates. If you are issuing a CIS invoice or a domestic reverse charge invoice you will just need to enter the correct VAT rate and add the reverse. Make a note on the invoice to make it clear that the domestic reverse charge applies and that the customer is required to account for the VAT wording example. Intra-EU supply of a new means of transport the details specified in Article 22b of the VAT Directive eg.

Source: eque2.co.uk

Source: eque2.co.uk

If you are issuing a CIS invoice or a domestic reverse charge invoice you will just need to enter the correct VAT rate and add the reverse. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. It even provides a range of suggested wording to be included on your invoice. As part of this when you use a reverse charge tax code the invoice or credit note you produce in should include the text shown in the below example. The template also has space that can be used for descriptions payments details and notes.

As a general rule businesses charge VAT on supplies and deduct VAT on purchases. This implies that if we are under the exception of the article we will not be the ones in charge of charging the VAT. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above. The Value-Added Tax VAT invoice must show. Intra-EU supply of a new means of transport the details specified in Article 22b of the VAT Directive eg.

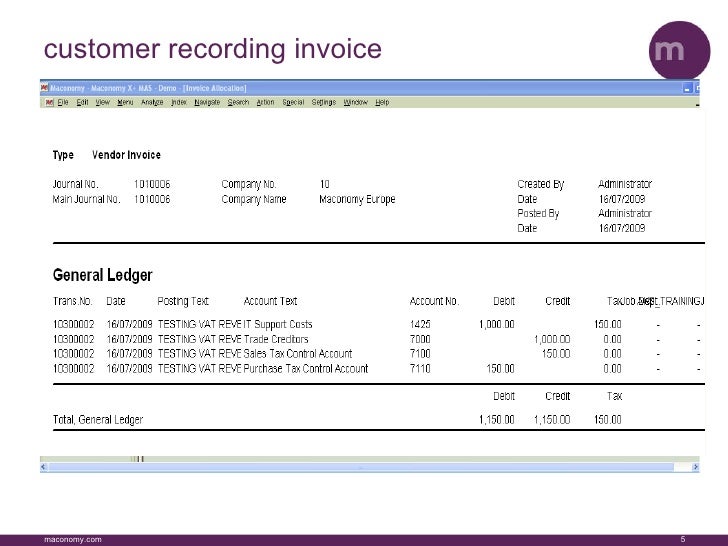

Source: pt.slideshare.net

Source: pt.slideshare.net

The suppliers full name address and registration number. In this scenario the tax liability is reversed and its the buyer that records the VAT on the invoice. Intra-EU supply of a new means of transport the details specified in Article 22b of the VAT Directive eg. Invoice Reverse Charge An invoice template is a straightforward document that an individual fills in the specifics of an agreement. This document explains the particular requirements relating to Reverse Charge supplies.

Source: astonshaw.co.uk

Source: astonshaw.co.uk

You will have to. This supply is subject to the reverse charge. An invoice template that can be printed is an. This does not apply to construction. The reverse charge mechanism is a deviation from this rule where the supplier does not charge VAT on the invoice and the customer pays and deducts VAT simultaneously through the VAT return.

Source: freeinvoicebuilder.com

Source: freeinvoicebuilder.com

You can find sample invoices online. Show all the information required on a VAT invoice. You can simply annotate the invoice reverse charge supply or make it much more legal-sounding by referring to the EC VAT Directive 2006112EC. Creating a Reverse Charge EC Services eg 20 will not help for reverse charge suppliers as this will produce an output in box 1 and box 6. Customer liable for the tax ie.

Source: okappy.com

Source: okappy.com

Creating a Reverse Charge EC Services eg 20 will not help for reverse charge suppliers as this will produce an output in box 1 and box 6. Excel invoice template for construction. If the supply falls under the reverse charge your invoice must. Example of a reverse charge invoice for one contract with different VAT rates. The template also has space that can be used for descriptions payments details and notes.

Source: warr.co.uk

Source: warr.co.uk

The VAT regulations 1995 say invoices for services subject to the reverse charge must include the reference reverse charge. If you use Excel to create your invoices we have provided some free invoice templates below. Under the regulation of the EU we do not charge VAT on services provided to VAT-registered businesses in other member countries. Invoice Reverse Charge An invoice template is a straightforward document that an individual fills in the specifics of an agreement. This implies that if we are under the exception of the article we will not be the ones in charge of charging the VAT.

Source: community.quickfile.co.uk

Source: community.quickfile.co.uk

You will have to. Reverse charge requirement under the missing trader intra-community rules. Customer liable for the tax ie. The suppliers full name address and registration number. Here are some examples of wording that meet the legal requirement.

Source: streetwisesubbie.com

Source: streetwisesubbie.com

This document explains the particular requirements relating to Reverse Charge supplies. As part of this when you use a reverse charge tax code the invoice or credit note you produce in should include the text shown in the below example. It even provides a range of suggested wording to be included on your invoice. Reverse charge is a change in the general rule of VAT that makes the recipient of the invoice responsible for declaring the tax to the Treasury. Feel free to check each template one by one.

Source: pt.slideshare.net

Source: pt.slideshare.net

You will have to. In this scenario the tax liability is reversed and its the buyer that records the VAT on the invoice. We have an article on how to add the reverse charge message to an invoice layout Report Designer - How to display VAT Reverse Charge message line on custom invoice and order layouts It looks like it has a couple of conditions to make it appear such as the tax code used on the invoice as well as the invoice amount. The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice. This supply is subject to the reverse charge.

Source: vtsoftware.co.uk

Source: vtsoftware.co.uk

Check out the Sample Invoice Template attached. In this scenario the tax liability is reversed and its the buyer that records the VAT on the invoice. Example of a reverse charge invoice for one contract with different VAT rates. These templates are downloadable and can be edited at your disposal. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above.

Source: pt.slideshare.net

Source: pt.slideshare.net

In the case of a reverse charge the customers VAT number and a notation that a reverse charge applies. There are 2 tabs one for non-VAT invoices and one for VAT invoices. Reverse charge is a change in the general rule of VAT that makes the recipient of the invoice responsible for declaring the tax to the Treasury. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above. Hi Paula Thanks for using Sage City.

Source: support.freeagent.com

Source: support.freeagent.com

Lets first take a look at an example where a VAT reverse charge would apply. Suppliers only declare sales with no VAT in box 6 but not a liability in box 1 as this is the purchaser obligations. Make a note on the invoice to make it clear that the domestic reverse charge applies and that the customer is required to account for the VAT wording example. Below youll find a sample domestic reverse charge VAT invoice. You can find sample invoices online.

Source: sagecity.com

Source: sagecity.com

We have an article on how to add the reverse charge message to an invoice layout Report Designer - How to display VAT Reverse Charge message line on custom invoice and order layouts It looks like it has a couple of conditions to make it appear such as the tax code used on the invoice as well as the invoice amount. Under the reverse-charge procedure the words Reverse charge. The template also has space that can be used for descriptions payments details and notes. This document explains the particular requirements relating to Reverse Charge supplies. It has a name of the company at the top and contact information on the lower left.

Intra-EU supply of a new means of transport the details specified in Article 22b of the VAT Directive eg. One 2nd article of the VAT law Law 371992 commonly known as the Reverse charge. The way in which margin scheme treatment is referenced on an invoice is a matter for the business and not HMRC but examples of acceptable indications include Reverse charge supply. The template also has space that can be used for descriptions payments details and notes. If you use Excel to create your invoices we have provided some free invoice templates below.

This does not apply to construction. Hi Paula Thanks for using Sage City. To demonstrate which items are subject to reverse charging you can use an invoice template which itemises all labour and materials and add the Item Tax Type merge field jobMaterialtax_rate as a column in your invoices table formatting to display the name of the tax rate applied next to each individual line item. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above. Lets first take a look at an example where a VAT reverse charge would apply.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

You could set up a new Invoice template in your accounts software. Feel free to check each template one by one. VAT 3 Return Example for Reverse Charge VAT 3 Return Headings Example Explanation Amount T1 VAT on Sale In its JanuaryFebruary 2019 VAT return A Ltd includes VAT of 181000 as VAT on Sales ie. Here are some examples of wording that meet the legal requirement. Check out the Sample Invoice Template attached.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title wording reverse charge vat invoice example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.