Your Vat reverse charge invoice example images are ready in this website. Vat reverse charge invoice example are a topic that is being searched for and liked by netizens now. You can Find and Download the Vat reverse charge invoice example files here. Get all royalty-free photos and vectors.

If you’re searching for vat reverse charge invoice example images information linked to the vat reverse charge invoice example interest, you have visit the ideal blog. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

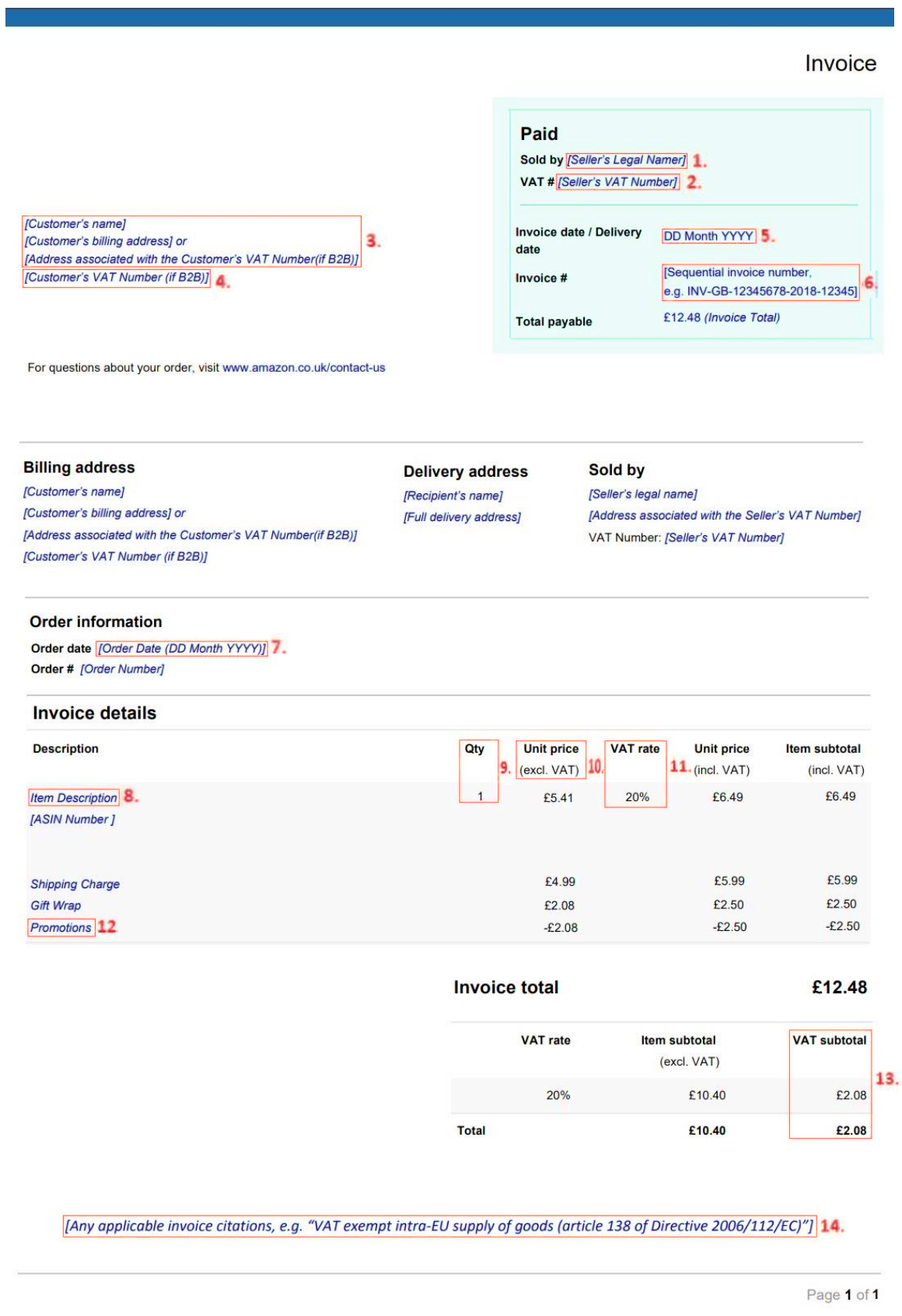

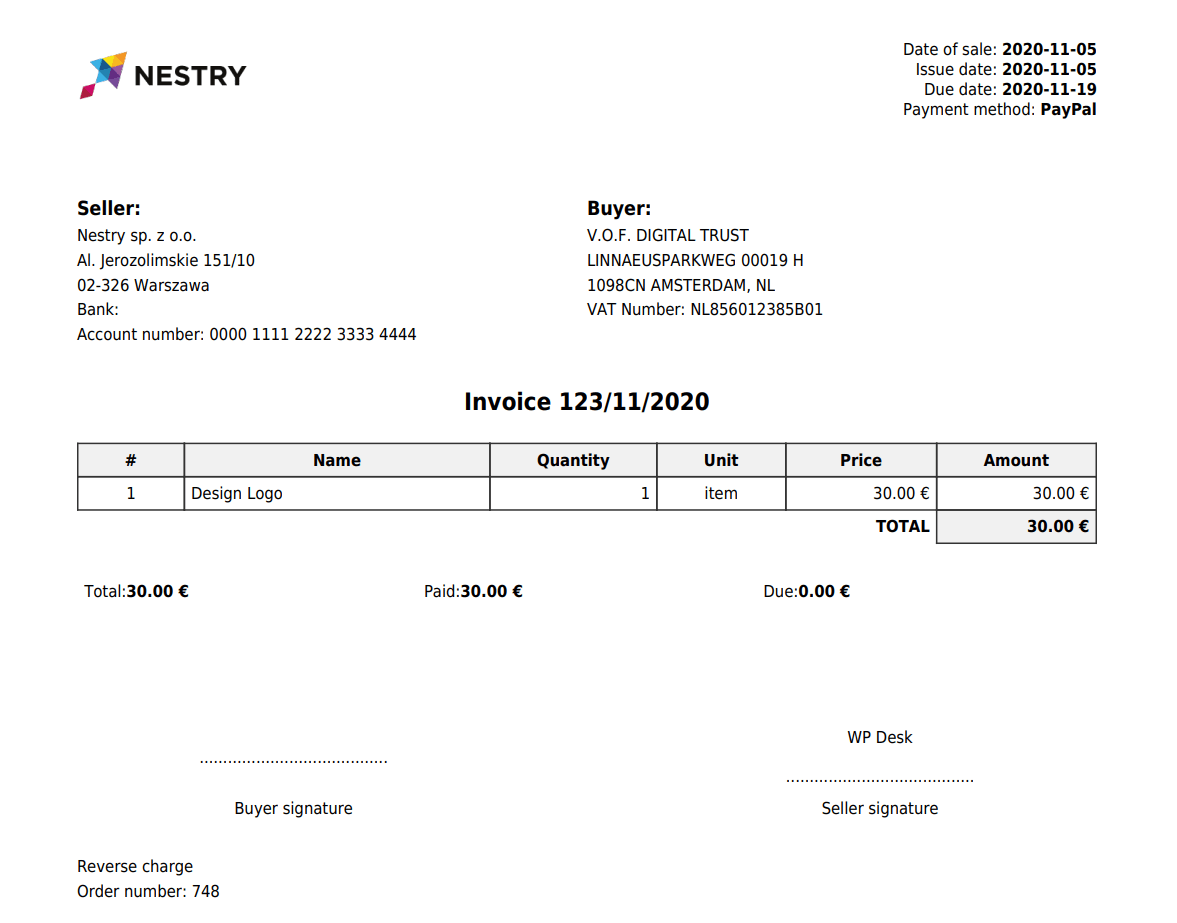

Vat Reverse Charge Invoice Example. We identified it from reliable source. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. A disclaimer outlining that the reverse charge applies to items marked with Domestic reverse charge and that customers need to account for VAT on these items to HMRC at the rate. VAT invoices are among the must-haves of a company whose lines of products or services are VAT imposable.

Vat The Domestic Reverse Charge Jt Thomas Accountants From jttaccounts.co.uk

Vat The Domestic Reverse Charge Jt Thomas Accountants From jttaccounts.co.uk

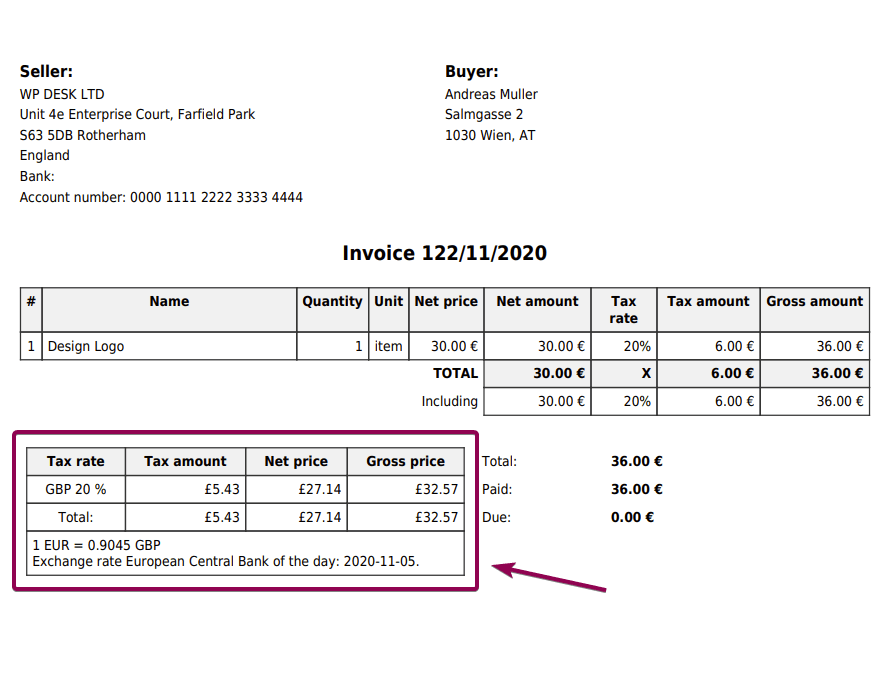

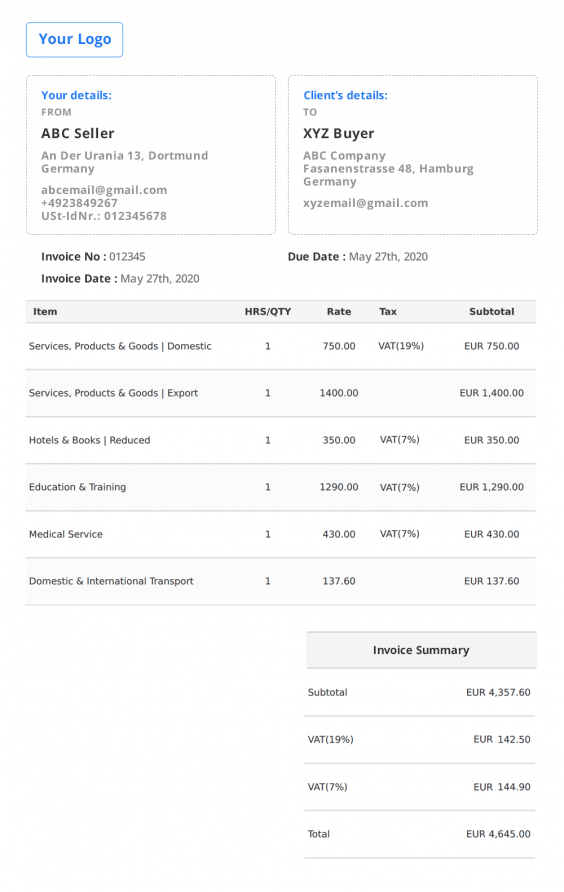

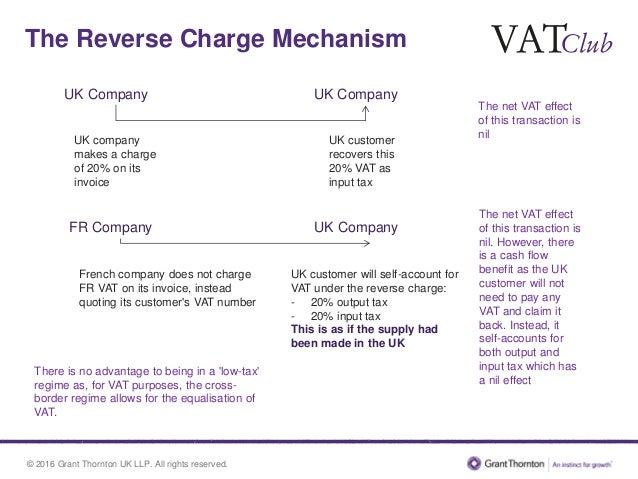

As a general rule businesses charge VAT on supplies and deduct VAT on purchases. Example of a reverse charge invoice for one contract with different VAT rates. We identified it from reliable source. A reverse VAT invoice is issued in special cases where transactions are subject to the VAT reverse charge mechanism. This is non-reverse charge work as the contractor is the end-user. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale.

A reverse VAT invoice is issued in special cases where transactions are subject to the VAT reverse charge mechanism.

Recipient is liable for VAT. VAT invoices are among the must-haves of a company whose lines of products or services are VAT imposable. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. Example of a reverse charge invoice for one contract with different VAT rates. The default invoice template is Invoice Template. Reverse Charge Invoice Format.

Source: jttaccounts.co.uk

Source: jttaccounts.co.uk

Customer to account to HMRC for the reverse charge output tax. Here are a number of highest rated Reverse Charge Invoice Format pictures upon internet. VAT invoices are among the must-haves of a company whose lines of products or services are VAT imposable. Reverse Charge Vat Invoice Example. As the reverse charge work is 476 of the total invoice value 500 10500 you need to charge 20 VAT on the whole.

Source: ordeconta.com

Source: ordeconta.com

As we mentioned in the earlier example the reverse charge means that the recipient rather than the provider is responsible for accounting for VAT on their VAT returns. The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice. You are a German entrepreneur you have goods in Rotterdam and you supply these to an entrepreneur established in the Netherlands. We identified it from reliable source. When you select Type 2 Invoice Layout in Sales Invoices Invoice Template 1 is used.

Source: pinterest.com

Source: pinterest.com

As a general rule businesses charge VAT on supplies and deduct VAT on purchases. In addition you must have the VAT identification. Here are a number of highest rated Reverse Charge Invoice Format pictures upon internet. This must now pay the VAT due on the service amount to. Example of reverse-charging relating to goods.

Source: flexibleinvoices.com

Source: flexibleinvoices.com

VAT Act 1994 Section 55A applies The second problem is a cashflow. The VAT regulations 1995 say invoices for services subject to the reverse charge must include the reference reverse charge. As a general rule businesses charge VAT on supplies and deduct VAT on purchases. A disclaimer outlining that the reverse charge applies to items marked with Domestic reverse charge and that customers need to account for VAT on these items to HMRC at the rate. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale.

Source: ordeconta.com

Source: ordeconta.com

Here are some examples of wording that meet the. As we mentioned in the earlier example the reverse charge means that the recipient rather than the provider is responsible for accounting for VAT on their VAT returns. This is non-reverse charge work as the contractor is the end-user. In this scenario the tax liability is reversed and. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale.

Source: eque2.co.uk

Source: eque2.co.uk

For many businesses understanding how a reverse charge VAT. When you select Type 2 Invoice Layout in Sales Invoices Invoice Template 1 is used. The VAT reverse charge is applied and they are responsible for the VAT using the reverse charge procedure. As the reverse charge work is 476 of the total invoice value 500 10500 you need to charge 20 VAT on the whole. This end-user suppose a retailer would include the value-added tax amount to its products.

Source: freeinvoicebuilder.com

Source: freeinvoicebuilder.com

However when business occurs between two businesses that are based in two different EU countries a reverse charge applies. A reverse VAT invoice is issued in special cases where transactions are subject to the VAT reverse charge mechanism. Example of a reverse charge invoice for one contract with different VAT rates. When you select Type 2 Invoice Layout in Sales Invoices Invoice Template 1 is used. Entering A Reverse Charge VAT Invoice.

Source: support.geekseller.com

Source: support.geekseller.com

Reverse Charge Vat Invoice Example. This end-user suppose a retailer would include the value-added tax amount to its products. A reverse VAT invoice is issued in special cases where transactions are subject to the VAT reverse charge mechanism. For many businesses understanding how a reverse charge VAT. Example of reverse-charging relating to goods.

This is non-reverse charge work as the contractor is the end-user. For many businesses understanding how a reverse charge VAT. We identified it from reliable source. Example of reverse-charging relating to goods. The invoice must now state that reverse charge applies.

Source: asset-temple.com

Source: asset-temple.com

Example of a reverse charge invoice for one contract with different VAT rates. As a general rule businesses charge VAT on supplies and deduct VAT on purchases. VAT invoices are among the must-haves of a company whose lines of products or services are VAT imposable. Reverse Charge Vat Invoice Example. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale.

Source: pinterest.com

Source: pinterest.com

In this scenario the tax liability is reversed and. We identified it from reliable source. The article offers several samples of VAT invoice templates such ash reverser. The end-user of goods or services will receive a reverse charged value-added tax on its invoice. Example of a reverse charge invoice for one contract with different VAT rates.

Source: slideshare.net

Source: slideshare.net

Example of reverse-charging relating to goods. We identified it from reliable source. You are a German entrepreneur you have goods in Rotterdam and you supply these to an entrepreneur established in the Netherlands. The HMRC example is as follows. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale.

In this scenario the tax liability is reversed and. Example of a reverse charge invoice for one contract with different VAT rates. A reverse VAT invoice is issued in special cases where transactions are subject to the VAT reverse charge mechanism. Here are some examples of approved. The article offers several samples of VAT invoice templates such ash reverser.

Source: flexibleinvoices.com

Source: flexibleinvoices.com

The article offers several samples of VAT invoice templates such ash reverser. This must now pay the VAT due on the service amount to. When you select Type 2 Invoice Layout in Sales Invoices Invoice Template 1 is used. Recipient is liable for VAT. This is non-reverse charge work as the contractor is the end-user.

The article offers several samples of VAT invoice templates such ash reverser. A disclaimer outlining that the reverse charge applies to items marked with Domestic reverse charge and that customers need to account for VAT on these items to HMRC at the rate. If you are a VAT-registered contractor customer you will instead account for both. As a general rule businesses charge VAT on supplies and deduct VAT on purchases. VAT Act 1994 Section 55A applies The second problem is a cashflow.

A disclaimer outlining that the reverse charge applies to items marked with Domestic reverse charge and that customers need to account for VAT on these items to HMRC at the rate. Here are some examples of approved. When you select Type 2 Invoice Layout in Sales Invoices Invoice Template 1 is used. However when business occurs between two businesses that are based in two different EU countries a reverse charge applies. Customer to account to HMRC for the reverse charge output tax.

Source: in.pinterest.com

Source: in.pinterest.com

It should also clearly state how much VAT in GBP the buyer should. The article offers several samples of VAT invoice templates such ash reverser. A reverse VAT invoice is issued in special cases where transactions are subject to the VAT reverse charge mechanism. The reverse charge mechanism is a deviation from this rule where the supplier. It should also clearly state how much VAT in GBP the buyer should.

The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice. Customer to account to HMRC for the reverse charge output tax. The HMRC example is as follows. However when business occurs between two businesses that are based in two different EU countries a reverse charge applies. We identified it from reliable source.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title vat reverse charge invoice example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.