Your Reverse charge vat example images are ready in this website. Reverse charge vat example are a topic that is being searched for and liked by netizens today. You can Find and Download the Reverse charge vat example files here. Download all free photos and vectors.

If you’re looking for reverse charge vat example images information related to the reverse charge vat example keyword, you have pay a visit to the ideal blog. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly surf and find more informative video content and images that fit your interests.

Reverse Charge Vat Example. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. You must complete your VAT return. Here VAT at 5 is levied on the supply of spare parts. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at.

Setting Up Domestic Reverse Charge For Sales Of Mobile Phones And Computer Chips From docs.pegasus.co.uk

Setting Up Domestic Reverse Charge For Sales Of Mobile Phones And Computer Chips From docs.pegasus.co.uk

Businesses registered in UAE are required to pay VAT on certain notified supplies like import of goods and services from overseas other VAT implementing GCC States on. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at. In some cases you do not have to charge VAT to your customers. Filing your VAT return. Here VAT at 5 is levied on the supply of spare parts. Operating lease in the lessees accounts under IFRS 16 ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019.

Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at.

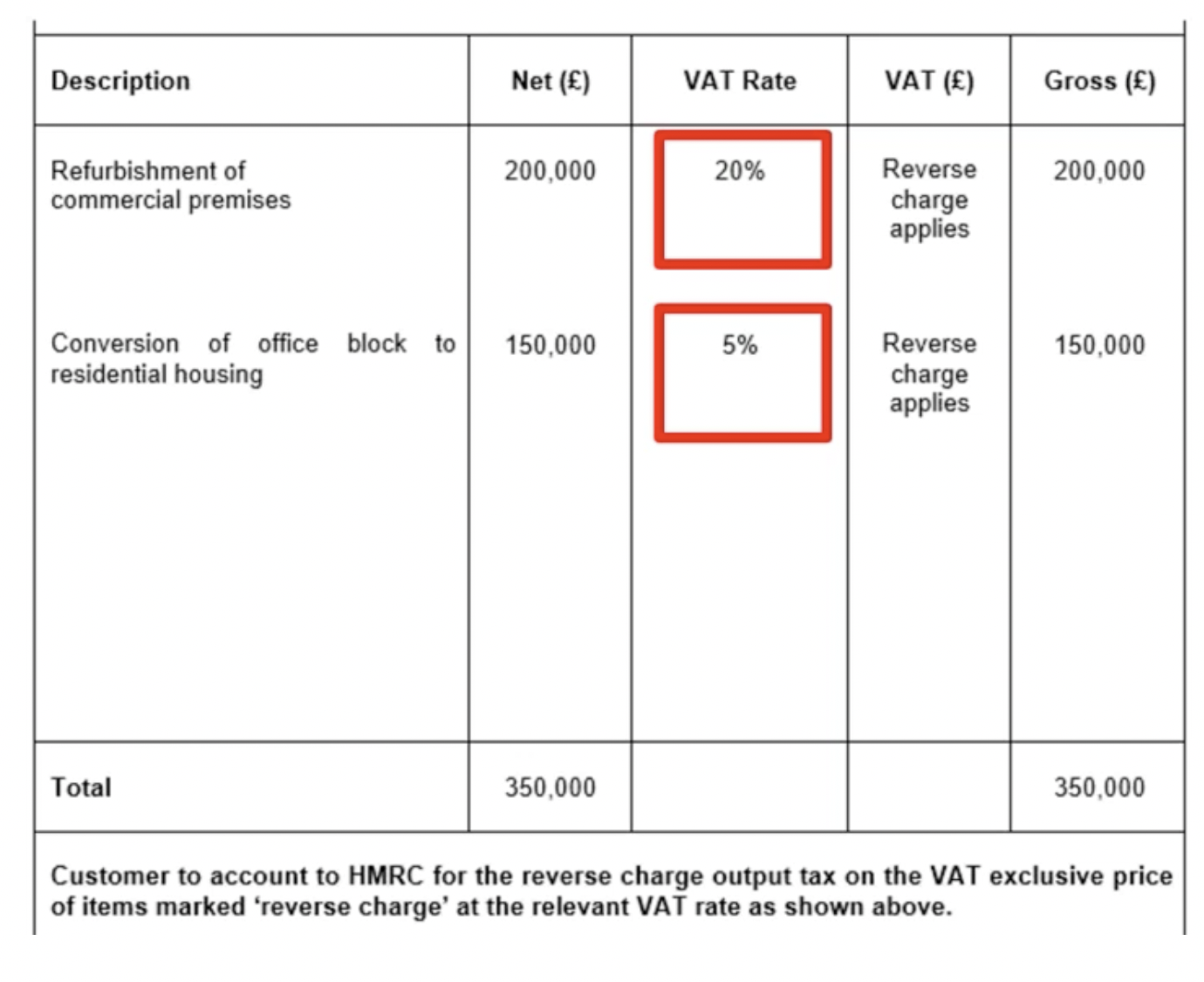

If more than 5 of contracts in value or volume are subject to the VAT reverse charge a contractor and subcontractor can agree to apply the charge to all contracts. In some cases you do not have to charge VAT to your customers. Example of a reverse charge invoice for one contract with different VAT rates. Businesses registered in UAE are required to pay VAT on certain notified supplies like import of goods and services from overseas other VAT implementing GCC States on. If more than 5 of contracts in value or volume are subject to the VAT reverse charge a contractor and subcontractor can agree to apply the charge to all contracts. Filing your VAT return.

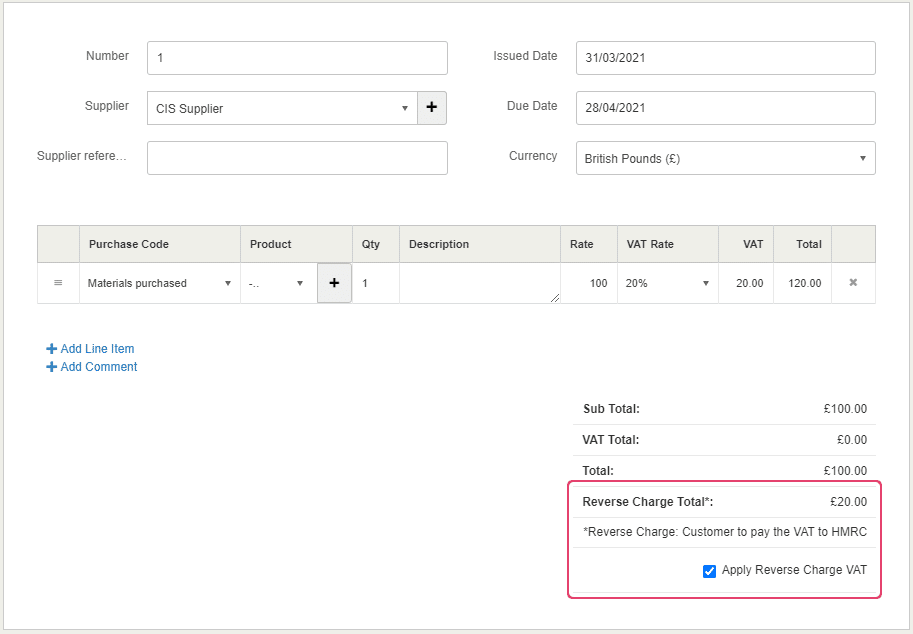

Source: kashflow.com

Source: kashflow.com

Businesses registered in UAE are required to pay VAT on certain notified supplies like import of goods and services from overseas other VAT implementing GCC States on. You must complete your VAT return. Filing your VAT return. This must be settled prior to the release of the goods from customs. Here VAT at 5 is levied on the supply of spare parts.

If the VAT reverse charge has already been used between two parties both parties can agree to future services on a site being subject to the reverse charge. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at. For example if the goods or services you provide are exempt from VAT such as childcare and the services of funeral directors. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. In some cases you do not have to charge VAT to your customers.

Source: eque2.co.uk

Source: eque2.co.uk

During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. For the purposes of EU VAT and customs bringing goods into the EU for the first time from another non-EU country is termed an import. You must complete your VAT return. Germany at 19 on the import transaction. Filing your VAT return.

Source: theconstructionindex.co.uk

Source: theconstructionindex.co.uk

For the purposes of EU VAT and customs bringing goods into the EU for the first time from another non-EU country is termed an import. Germany at 19 on the import transaction. For example if the goods or services you provide are exempt from VAT such as childcare and the services of funeral directors. Operating lease in the lessees accounts under IFRS 16 ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019. You must complete your VAT return.

Source: aiq.helpjuice.com

Source: aiq.helpjuice.com

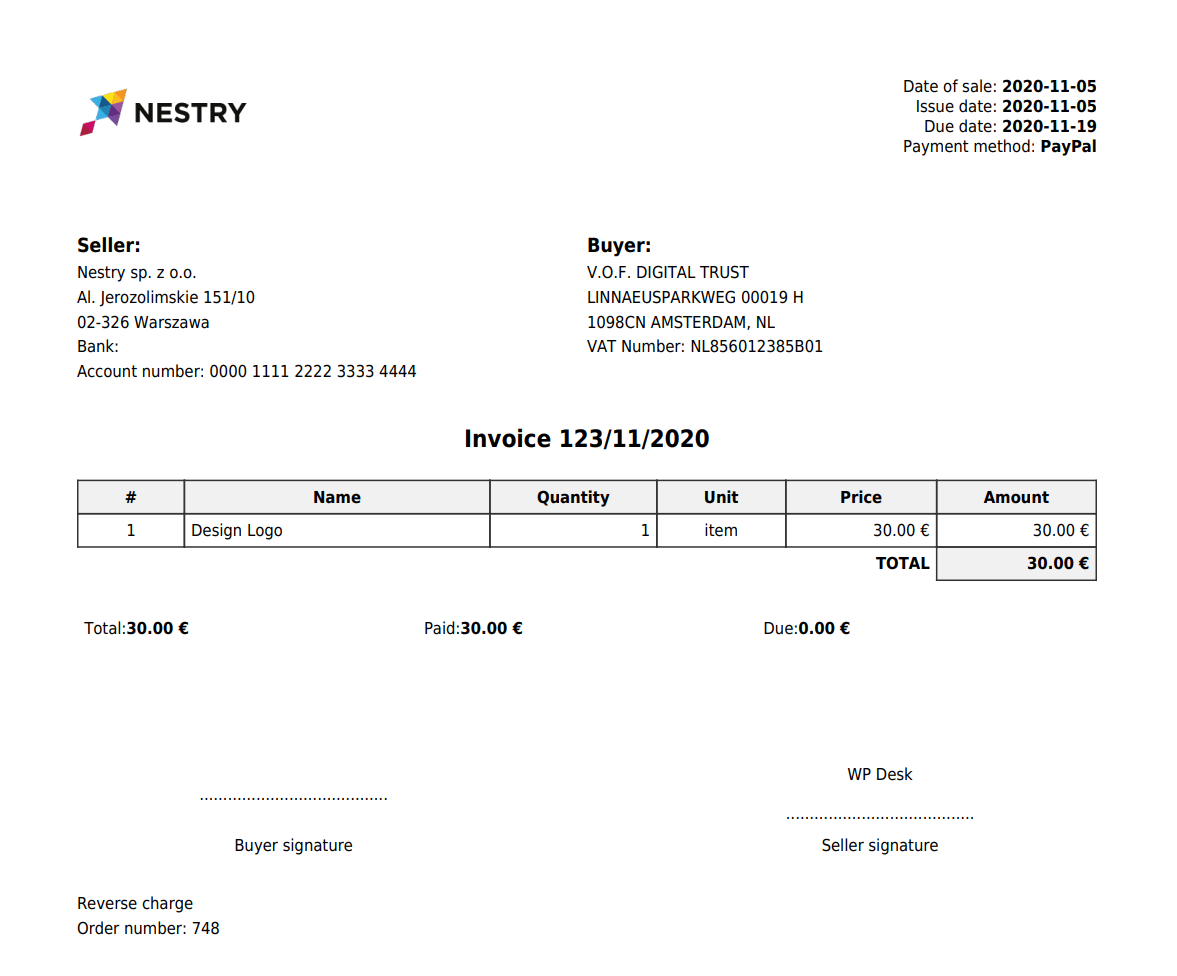

Or you can use the reverse-charge arrangement when you reverse-charge the VAT to the buyer. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. You must complete your VAT return. Germany at 19 on the import transaction. Or you can use the reverse-charge arrangement when you reverse-charge the VAT to the buyer.

Source: youtube.com

Source: youtube.com

Generally the country of arrival will look to charge its standard VAT rate eg. Example of a reverse charge invoice for one contract with different VAT rates. If the VAT reverse charge has already been used between two parties both parties can agree to future services on a site being subject to the reverse charge. You must complete your VAT return. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at.

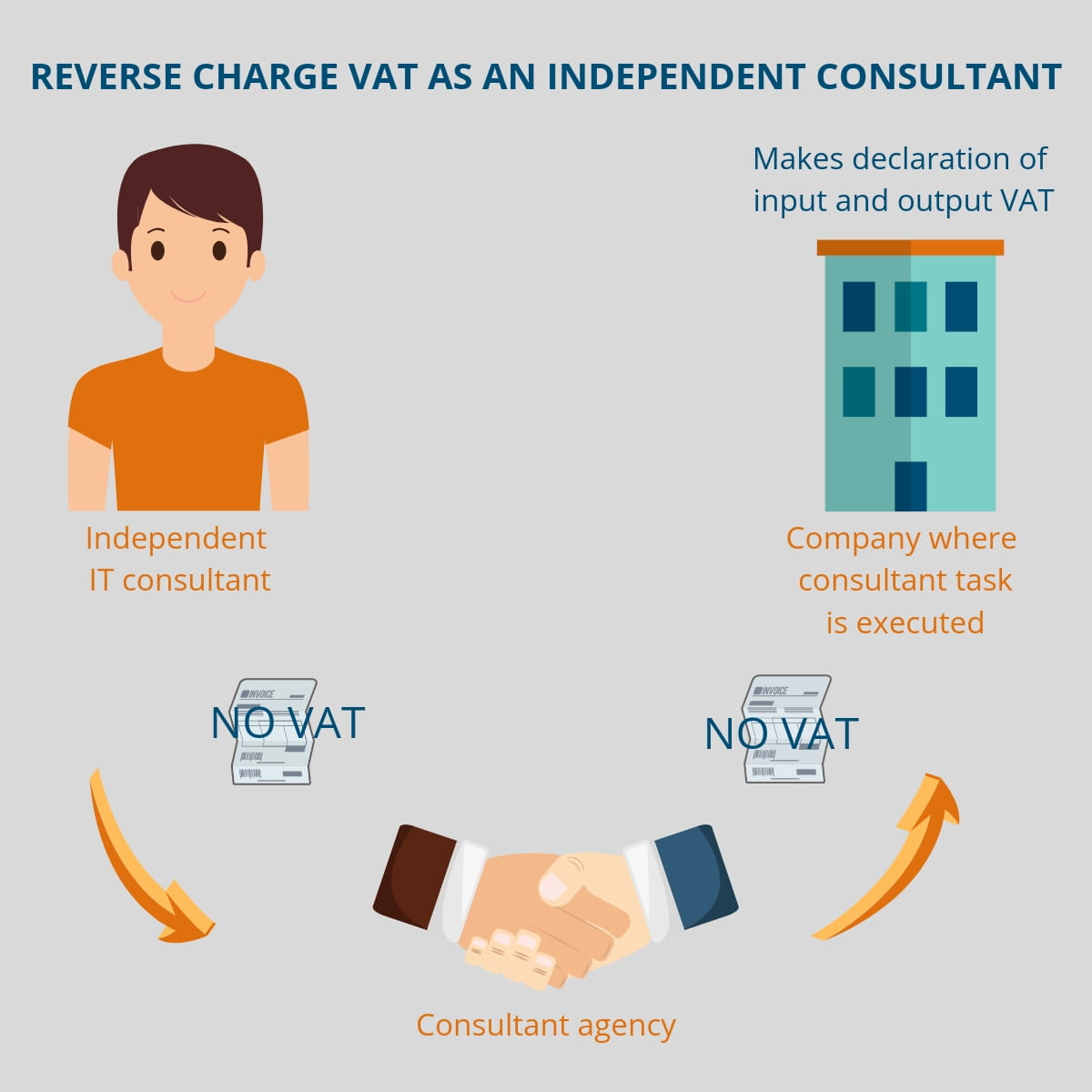

Source: rightpeoplegroup.com

Source: rightpeoplegroup.com

Or you can use the reverse-charge arrangement when you reverse-charge the VAT to the buyer. For example if the goods or services you provide are exempt from VAT such as childcare and the services of funeral directors. Here VAT at 5 is levied on the supply of spare parts. If more than 5 of contracts in value or volume are subject to the VAT reverse charge a contractor and subcontractor can agree to apply the charge to all contracts. Filing your VAT return.

If more than 5 of contracts in value or volume are subject to the VAT reverse charge a contractor and subcontractor can agree to apply the charge to all contracts. Example of a reverse charge invoice for one contract with different VAT rates. If the VAT reverse charge has already been used between two parties both parties can agree to future services on a site being subject to the reverse charge. Generally the country of arrival will look to charge its standard VAT rate eg. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments.

Source: brightpay.co.uk

Source: brightpay.co.uk

Operating lease in the lessees accounts under IFRS 16 ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. Operating lease in the lessees accounts under IFRS 16 ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019. Businesses registered in UAE are required to pay VAT on certain notified supplies like import of goods and services from overseas other VAT implementing GCC States on.

Source: help.brightpearl.com

Source: help.brightpearl.com

Example of a reverse charge invoice for one contract with different VAT rates. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. Operating lease in the lessees accounts under IFRS 16 ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019. If the VAT reverse charge has already been used between two parties both parties can agree to future services on a site being subject to the reverse charge. In some cases you do not have to charge VAT to your customers.

Example of a reverse charge invoice for one contract with different VAT rates. Germany at 19 on the import transaction. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at. Generally the country of arrival will look to charge its standard VAT rate eg.

Source: flexibleinvoices.com

Source: flexibleinvoices.com

In some cases you do not have to charge VAT to your customers. For the purposes of EU VAT and customs bringing goods into the EU for the first time from another non-EU country is termed an import. For example if the goods or services you provide are exempt from VAT such as childcare and the services of funeral directors. You must complete your VAT return. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments.

Source: docs.pegasus.co.uk

Source: docs.pegasus.co.uk

For example if the goods or services you provide are exempt from VAT such as childcare and the services of funeral directors. Here VAT at 5 is levied on the supply of spare parts. Example of a reverse charge invoice for one contract with different VAT rates. If the VAT reverse charge has already been used between two parties both parties can agree to future services on a site being subject to the reverse charge. In some cases you do not have to charge VAT to your customers.

Source: joblogic.com

Source: joblogic.com

Example of a reverse charge invoice for one contract with different VAT rates. Generally the country of arrival will look to charge its standard VAT rate eg. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. This must be settled prior to the release of the goods from customs. For the purposes of EU VAT and customs bringing goods into the EU for the first time from another non-EU country is termed an import.

Source: rightpeoplegroup.com

Source: rightpeoplegroup.com

Filing your VAT return. In some cases you do not have to charge VAT to your customers. Operating lease in the lessees accounts under IFRS 16 ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019. Here VAT at 5 is levied on the supply of spare parts. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at.

Source: community.quickfile.co.uk

Source: community.quickfile.co.uk

Operating lease in the lessees accounts under IFRS 16 ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019. If more than 5 of contracts in value or volume are subject to the VAT reverse charge a contractor and subcontractor can agree to apply the charge to all contracts. Businesses registered in UAE are required to pay VAT on certain notified supplies like import of goods and services from overseas other VAT implementing GCC States on. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at. Or you can use the reverse-charge arrangement when you reverse-charge the VAT to the buyer.

Source: streetwisesubbie.com

Source: streetwisesubbie.com

Germany at 19 on the import transaction. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. Generally the country of arrival will look to charge its standard VAT rate eg. This must be settled prior to the release of the goods from customs. If the VAT reverse charge has already been used between two parties both parties can agree to future services on a site being subject to the reverse charge.

Germany at 19 on the import transaction. Example of a reverse charge invoice for one contract with different VAT rates. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. In some cases you do not have to charge VAT to your customers. If the VAT reverse charge has already been used between two parties both parties can agree to future services on a site being subject to the reverse charge.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title reverse charge vat example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.