Your Related party transactions examples images are available. Related party transactions examples are a topic that is being searched for and liked by netizens today. You can Find and Download the Related party transactions examples files here. Download all royalty-free photos.

If you’re searching for related party transactions examples pictures information related to the related party transactions examples interest, you have visit the right site. Our site always gives you hints for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

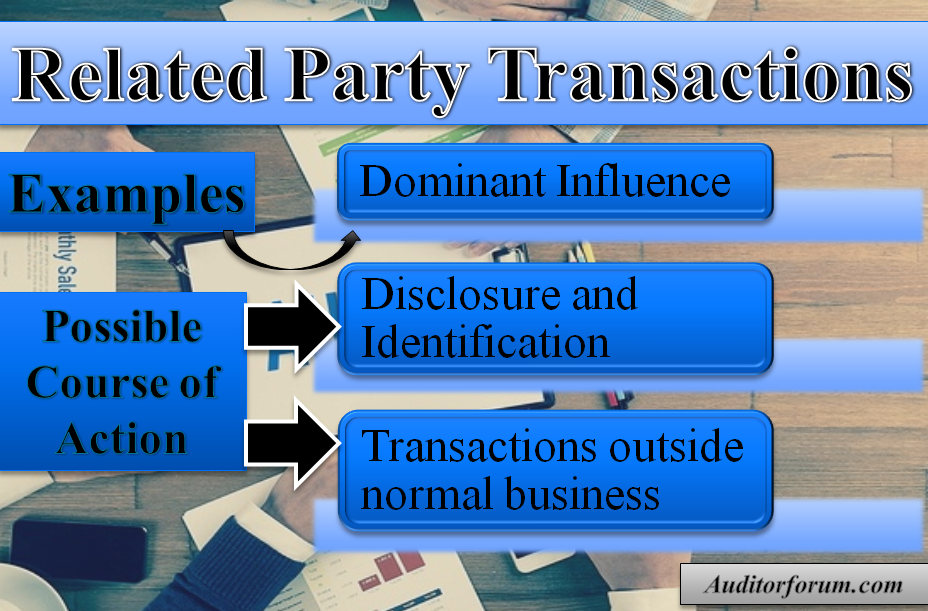

Related Party Transactions Examples. Thus a related party transaction is a transaction that occurs between two or more parties with inter-linking relationships. Use of property and equipment by lease or. C and entity and its principal owners and d affiliates. Related Party Transactions and Corporate Governance 3 Despite this interest in related party transactions there is limited academic research to understand the nature of related party transactions and their economic consequences.

As 18 Presentation From slideshare.net

As 18 Presentation From slideshare.net

Schedule of Related Party Transactions by Related Party. What do you mean by this term related party transactions. Related party transactions may not be conducted under normal market terms and conditions for example some related party transactions may be conducted with no exchange of considera-tion. Any Related Party Transaction in which a Director an Immediate Family Member of a Director a 5 Shareholder or if such 5 Shareholder is a natural person an Immediate Family member of such 5 Shareholder has a material interest. A related party transaction is a transfer of resources services or obligations between a reporting entity and a related party regardless of whether a price is charged. Related Party Transactions and Corporate Governance 3 Despite this interest in related party transactions there is limited academic research to understand the nature of related party transactions and their economic consequences.

For example an entity may received services from a related party without charge and not record receipt of the services.

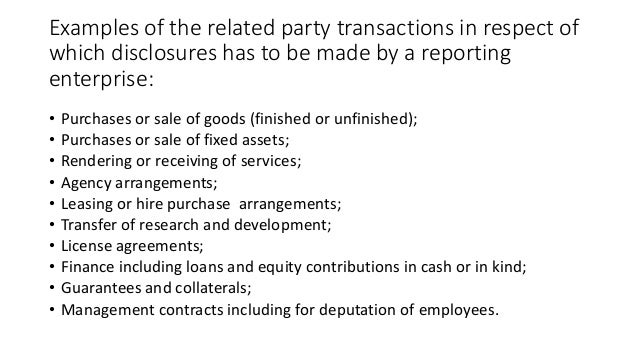

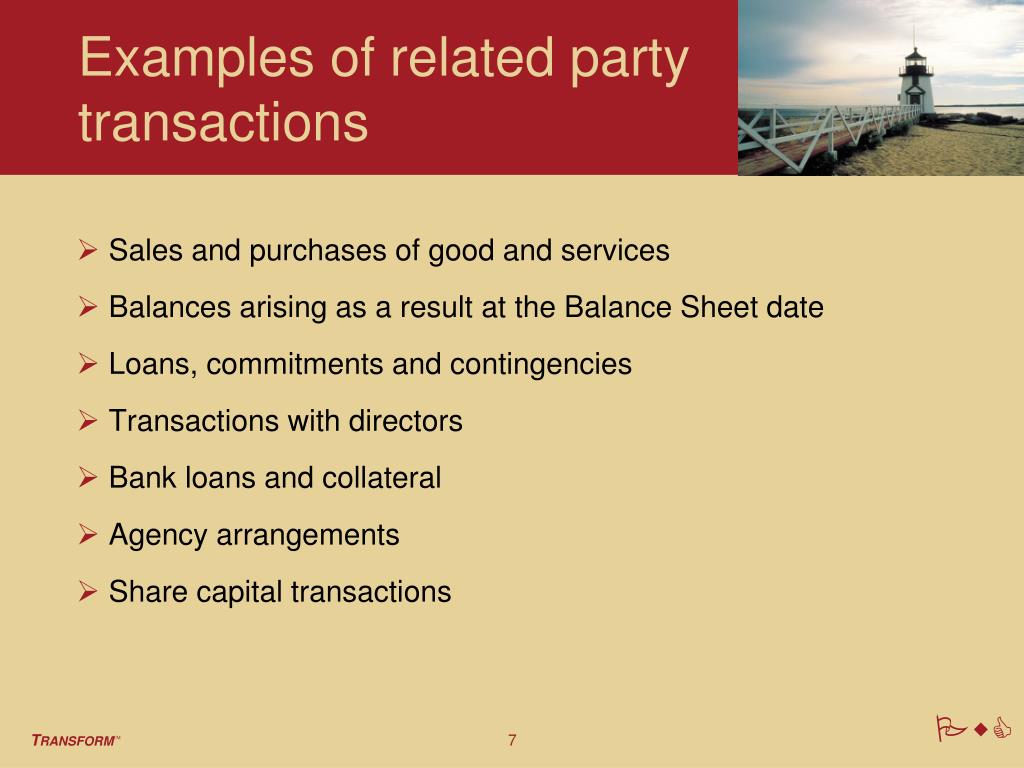

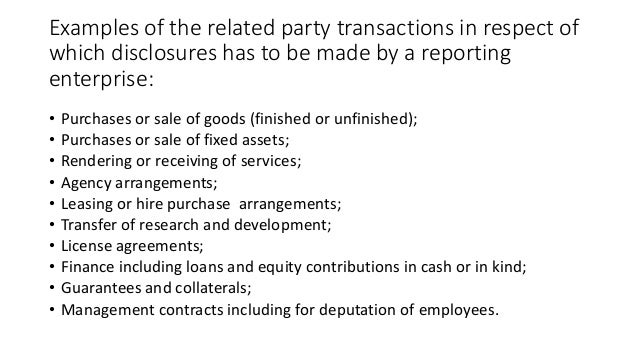

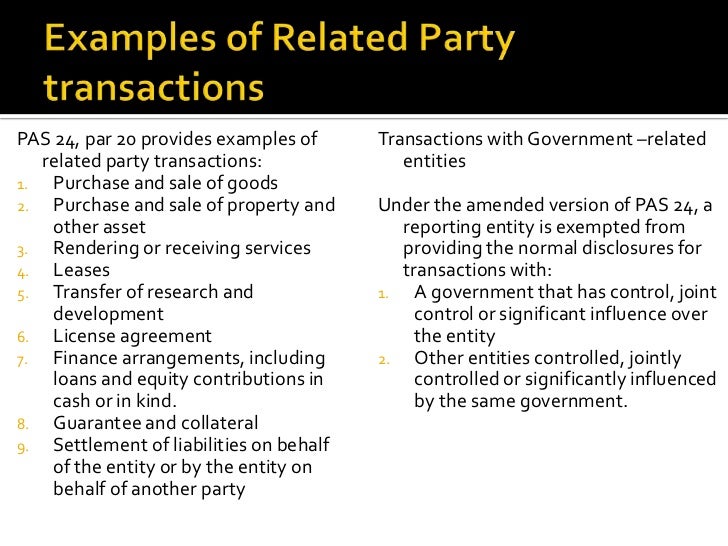

Tabular disclosure of related party transactions. Gain an understanding of related party transactions by learning the definition and through application of examples and. Tabular disclosure of related party transactions. Examples of Related-Party Transactions FASB RPT Examples IASB RPT Examples a Sales purchases and transfers of realty and personal property b Services received or furnished such as accounting management engineering and legal services c Use of property or equipment by lease or otherwise d Borrowings and lendings e Guarantees. A list of the companys current related parties and associated transactions. Use of property and equipment by lease or.

Source: researchgate.net

Source: researchgate.net

C and entity and its principal owners and d affiliates. This involves the disclosures noted below. Services received or furnished such as accounting management engineering and legal services. What do you mean by this term related party transactions. Depending on the transactions it may be acceptable to aggregate some related party information by type of transaction.

Source: slideserve.com

Source: slideserve.com

Any Related Party Transaction with a value of 50 million or more in. Specifically in the nonprofit sector a related. Examples of common transactions with related parties are. Related party transactions may be motivated solely or in large measure to engage in fraudulent financial reporting or conceal misappropriationofassets. C and entity and its principal owners and d affiliates.

Source: annualreporting.info

Source: annualreporting.info

Learn more by exploring examples and an analysis. For example an entity may received services from a related party without charge and not record receipt of the services. FASB ASC 850-10-05-5 states that transactions between related parties are considered to be related party transactions even though they may not be given accounting recognition. Illustrate your comment with examples of related parties and types of transactions. What do you mean by this term related party transactions.

Source: researchgate.net

Source: researchgate.net

Any Related Party Transaction with a value of 50 million or more in. Given the potential for double dealing with related parties auditors spend significant time hunting for undisclosed related-party transactions. These disclosures should be made separately for categories of related parties as specified in IAS 2419. What steps do you consider should be incorporated into your audit work to minimize the risk of similar criticism being levelled at your fi rm. Borrowing or lending on an interest-free basis or at a rate of interest significantly different than rates in effect at the transaction date Selling real estate at a price that differs significantly from its appraised value.

Source: slideshare.net

Source: slideshare.net

C and entity and its principal owners and d affiliates. A related-party transaction is a transaction that happens between the reporting entity and either another entity that is considered related or a person that has a direct or indirect relationship with the reporting entity. Related party transactions can include any regular transaction between 2 businesses but those businesses are affiliated or related in any way. Related Party Transactions and Corporate Governance 3 Despite this interest in related party transactions there is limited academic research to understand the nature of related party transactions and their economic consequences. Thus a related party transaction is a transaction that occurs between two or more parties with inter-linking relationships.

Source: annualreporting.info

Source: annualreporting.info

June 8 2020. June 8 2020. Transactions between related parties commonly occur in the normal course of business. Related Party Transaction is a transaction deal arrangement between two related parties for the transfer of resources services or obligations irrespective of whether a price is charged and it can have an effect on the statement of profit or loss and financial position of an entity. Thus a related party transaction is a transaction that occurs between two or more parties with inter-linking relationships.

Source: taxguru.in

Source: taxguru.in

These disclosures should be made separately for categories of related parties as specified in IAS 2419. ASPE 3840 provides guidance on how to measure and disclose related-party transactions. Related party transactions can include any regular transaction between 2 businesses but those businesses are affiliated or related in any way. Related party transactions may not be conducted under normal market terms and conditions for example some related party transactions may be conducted with no exchange of considera-tion. Examples of Related-Party Transactions FASB RPT Examples IASB RPT Examples a Sales purchases and transfers of realty and personal property b Services received or furnished such as accounting management engineering and legal services c Use of property or equipment by lease or otherwise d Borrowings and lendings e Guarantees.

Source: taxguru.in

Source: taxguru.in

Specifically in the nonprofit sector a related. Related Party Transaction is a transaction deal arrangement between two related parties for the transfer of resources services or obligations irrespective of whether a price is charged and it can have an effect on the statement of profit or loss and financial position of an entity. A related party transaction is a transfer of resources services or obligations between a reporting entity and a related party regardless of whether a price is charged. There are no business relationships or related-party transactions involving the Company or any of its subsidiaries or any other person required to be described in the Registration Statement the Time of Sale Prospectus or the Prospectus that have not been described as required. A related party transaction is defined as a transfer of resources services or obligations between a reporting entity and a related party regardless of whether a price is charged IAS 249.

Source: slideshare.net

Source: slideshare.net

In accounting related parties refers to transactions that occur between two parties that have a preexisting relationship. C and entity and its principal owners and d affiliates. Related party transactions may not be conducted under normal market terms and conditions for example some related party transactions may be conducted with no exchange of considera-tion. What do you mean by this term related party transactions. Services received or furnished such as accounting management engineering and legal services.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

FASB ASC 850-10-05-5 states that transactions between related parties are considered to be related party transactions even though they may not be given accounting recognition. In this paper we offer two main contributions to enhance our understanding of these types of transactions. June 8 2020. What do you mean by this term related party transactions. Of the following Related Party Transactions.

Source: slideplayer.com

Source: slideplayer.com

Any Related Party Transaction with a value of 50 million or more in. A related party transaction is an important concept of financial reporting. Related party transactions may not be conducted under normal market terms and conditions for example some related party transactions may be conducted with no exchange of considera-tion. C and entity and its principal owners and d affiliates. A related party transaction is defined as a transfer of resources services or obligations between a reporting entity and a related party regardless of whether a price is charged IAS 249.

Learn more by exploring examples and an analysis. Learn more by exploring examples and an analysis. Borrowing or lending on an interest-free basis or at a rate of interest significantly different than rates in effect at the transaction date Selling real estate at a price that differs significantly from its appraised value. Given the potential for double dealing with related parties auditors spend significant time hunting for undisclosed related-party transactions. Related party transactions may not be conducted under normal market terms and conditions for example some related party transactions may be conducted with no exchange of considera-tion.

Source: slideplayer.com

Source: slideplayer.com

B subsidiaries of a common parent. This can often occur between businesses where ownerships are shared or. What do you mean by this term related party transactions. In this paper we offer two main contributions to enhance our understanding of these types of transactions. In accounting related parties refers to transactions that occur between two parties that have a preexisting relationship.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

Any Related Party Transaction with a value of 50 million or more in. Any Related Party Transaction with a value of 50 million or more in. Related Party Disclosures. A related party transaction is an important concept of financial reporting. Schedule of Related Party Transactions by Related Party.

Examples of related party transactions include but are not limited to transactions between a a parent company and its subsidiary. What do you mean by this term related party transactions. Examples of documents and data sources that can help uncover these transactions are. Borrowing or lending on an interest-free basis or at a rate of interest significantly different than rates in effect at the transaction date Selling real estate at a price that differs significantly from its appraised value. In general any related party transaction should be disclosed that would impact the decision making of the users of a companys financial statements.

Source: auditor101.com

Source: auditor101.com

Examples of related party transactions include but are not limited to transactions between a a parent company and its subsidiary. Related Party Transactions and Corporate Governance 3 Despite this interest in related party transactions there is limited academic research to understand the nature of related party transactions and their economic consequences. Related Party Transaction is a transaction deal arrangement between two related parties for the transfer of resources services or obligations irrespective of whether a price is charged and it can have an effect on the statement of profit or loss and financial position of an entity. In general any related party transaction should be disclosed that would impact the decision making of the users of a companys financial statements. Examples of related party transactions include but are not limited to transactions between a a parent company and its subsidiary.

Source: slideplayer.com

Source: slideplayer.com

Of the following Related Party Transactions. There are no business relationships or related-party transactions involving the Company or any of its subsidiaries or any other person required to be described in the Registration Statement the Time of Sale Prospectus or the Prospectus that have not been described as required. ASPE 3840 provides guidance on how to measure and disclose related-party transactions. Thus a related party transaction is a transaction that occurs between two or more parties with inter-linking relationships. This can often occur between businesses where ownerships are shared or.

Source: accountingclarified.com

Source: accountingclarified.com

In general any related party transaction should be disclosed that would impact the decision making of the users of a companys financial statements. Examples of common transactions with related parties are. Schedule of Related Party Transactions by Related Party. Sales purchases and transfers of real and personal property. This involves the disclosures noted below.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title related party transactions examples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.