Your Private operating foundation examples images are available. Private operating foundation examples are a topic that is being searched for and liked by netizens now. You can Find and Download the Private operating foundation examples files here. Download all free images.

If you’re searching for private operating foundation examples images information connected with to the private operating foundation examples topic, you have visit the ideal site. Our website frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

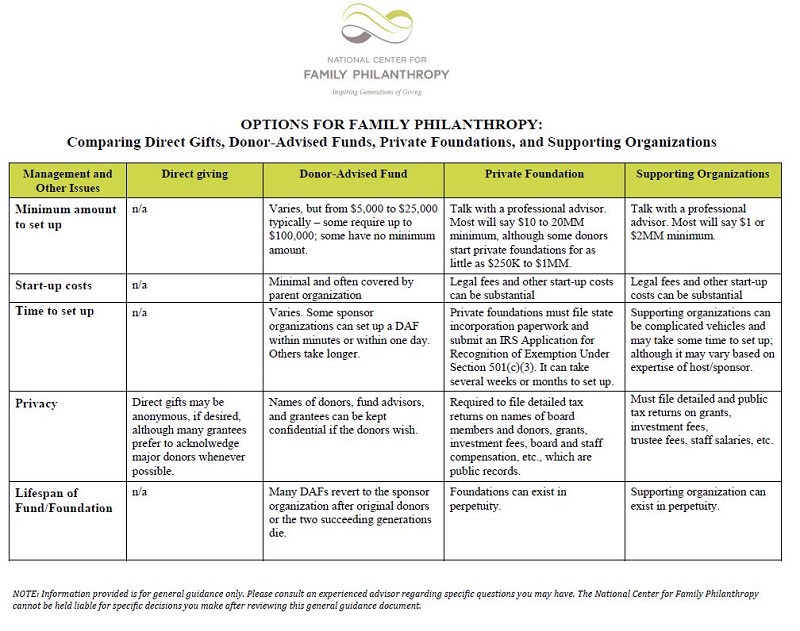

Private Operating Foundation Examples. They make few if any grants to outside organizations. Like other traditional private foundations a private operating foundation is a federally tax-exempt organization under IRC Section 501c3 that is funded primarily by one or a few donors and thus cannot meet the public charity support or facts and circumstances tests. In 2008 of which 110099 were grantmaking non-operating and 5241 were operating foundations. Examples are POF payroll for personnel involved in managing the charitable program cost of materials and marketing.

International Tax Accountants Firm. Examples Private Non-Operating Foundation Famous Author makes donations to Smith Family Foundation a private non-operating foundation PNF. These organizations are called private operating foundations because they are private foundations that actively conduct their. These foundations typically make grants to public charities and they make up the vast majority of the private foundation community. In 2008 of which 110099 were grantmaking non-operating and 5241 were operating foundations. A private operating foundation is a foundation that enjoys certain advantages available to public charities but in all other respects is treated as a private foundation.

A private operating foundation is a 501 c 3 tax-exempt private foundation that devotes most of its resources ie earnings andor assets toward the active conduct of its tax-exempt activities.

The Foundation Finances Database 20072009. Operating foundations are private foundations that use the bulk of their income to provide charitable services or to run charitable programs of their own. Donors with missions as distinct and specific as that of Pierre Goodrich may well see a private operating foundation as their most effective vehicle for philanthropy. Ancient book that Foundation donates to public library Hand-written manuscript of Authors first novel that Foundation donates to public library Basis zero. A 2006 study by the Council on Foundations for example revealed that median private foundation. Unlike private foundations that are not operating a private operating foundation is required to spend a certain portion of its assets each year on charitable activities.

Source: pfc.ca

Source: pfc.ca

While a private operating foundation can be closely held and have funding from a limited number of sources the private operating foundation must operate programs directly benefiting the public and cannot consider giving away funding as a program. For example charity to a private foundation qualified for a higher charitable deduction limit on the donors tax return. Operating foundations are private foundations that use the bulk of their income to provide charitable services or to run charitable programs of their own. Costs as a percent of a foundations total assets as a percent of a foundations total grants and as a percent of a foundations total payout. While a private operating foundation can be closely held and have funding from a limited number of sources the private operating foundation must operate programs directly benefiting the public and cannot consider giving away funding as a program.

Source: 501c3.org

Source: 501c3.org

Sample includes 1171 foundations that ranked. Because of this emphasis on charitable activities a private operating foundation receives many of the same tax benefits as a public charity without needing to adhere to the public support test requirements. A less common type of private foundation is a private operating foundation. Costs as a percent of a foundations total assets as a percent of a foundations total grants and as a percent of a foundations total payout. Like other traditional private foundations a private operating foundation is a federally tax-exempt organization under IRC Section 501c3 that is funded primarily by one or a few donors and thus cannot meet the public charity support or facts and circumstances tests.

Source: pinterest.com

Source: pinterest.com

To demonstrate that it is a private operating base an organization must meet an asset test support test or. In protecting donor intent operating foundations have one obvious advantage. For example charity to a private foundation qualified for a higher charitable deduction limit on the donors tax return. Authority is vested in a board of trustees working in compliance with state and federal laws in addition to the philanthropys own bylaws trust agreement or articles of incorporation. Private operating foundation is a legal classification under the Internal Revenue Code and these foundations must follow many of the private foundation rules.

Source: foundationsource.com

Source: foundationsource.com

Tax Period The date of the latest return filed. Examples Private Non-Operating Foundation Famous Author makes donations to Smith Family Foundation a private non-operating foundation PNF. Because of this emphasis on charitable activities a private operating foundation receives many of the same tax benefits as a public charity without needing to adhere to the public support test requirements. Unlike private foundations that are not operating a private operating foundation is required to spend a certain portion of its assets each year on charitable activities. They can conduct their own direct charitable activities and make grants to individuals award scholarships make grants to international organizations that arent recognized as 501c.

Source: 501c3.org

Source: 501c3.org

While a private operating foundation can be closely held and have funding from a limited number of sources the private operating foundation must operate programs directly benefiting the public and cannot consider giving away funding as a program. In exchange the private operating foundation allows public charity levels of deductibility for. Examples Private Non-Operating Foundation Famous Author makes donations to Smith Family Foundation a private non-operating foundation PNF. To qualify as an operating foundation specific rules in addition to the applicable rules for private. Unlike private foundations that are not operating a private operating foundation is required to spend a certain portion of its assets each year on charitable activities.

Source: 501c3.org

Source: 501c3.org

The foundation may also be funded with a bequest from the donors will or trust or receive funds as the primary or secondary beneficiary of a qualified plan or IRAThe IRS reports that there were 115340 private foundations in the US. Instead endowments fund independent foundations through a single source like an individual or. Private operating foundation is a legal classification under the Internal Revenue Code and these foundations must follow many of the private foundation rules. It is intended as an overview of planning considerations and reference outline for the practitioner to help clients define and achieve their philanthropic goals2 II. A private operating foundation is a private foundation that conducts charitable activities as opposed to solely making charitable grants.

Examples of operating foundations. Like other traditional private foundations a private operating foundation is a federally tax-exempt organization under IRC Section 501c3 that is funded primarily by one or a few donors and thus cannot meet the public charity support or facts and circumstances tests. Under the assets test 65 percent or more of a private operating foundation. These foundations typically make grants to public charities and they make up the vast majority of the private foundation community. In 2008 of which 110099 were grantmaking non-operating and 5241 were operating foundations.

Source: pinterest.com

Source: pinterest.com

In protecting donor intent operating foundations have one obvious advantage. Sample 990 Files click ot view Download All Form 990s. Examples of private operating foundations include. A less common type of private foundation is a private operating foundation. Private operating foundation examples can include museums zoos research facilities and libraries.

Source: ncfp.org

Source: ncfp.org

The Foundation Finances Database 20072009. The Foundation Finances Database 20072009. Sample 990 Files click ot view Download All Form 990s. Examples are POF payroll for personnel involved in managing the charitable program cost of materials and marketing. Donors with missions as distinct and specific as that of Pierre Goodrich may well see a private operating foundation as their most effective vehicle for philanthropy.

A private operating foundation is a foundation that enjoys certain advantages available to public charities but in all other respects is treated as a private foundation. Tax Period The date of the latest return filed. In protecting donor intent operating foundations have one obvious advantage. Sample includes 1171 foundations that ranked. International Tax Accountants Firm.

Source: foundationsource.com

Source: foundationsource.com

A 2006 study by the Council on Foundations for example revealed that median private foundation. Staffed Versus unstaffed Large independent Foundations by giving range 20072009 Source. Importance of considering a foundations operating characteristics when assessing its expenditures. Ancient book that Foundation donates to public library Hand-written manuscript of Authors first novel that Foundation donates to public library Basis zero. Examples of private operating foundations include.

Source: investopedia.com

Source: investopedia.com

A less common type of private foundation is a private operating foundation. By default all domes-tic or foreign organizations described in Section 501c3 are private foundations and it is only by satisfying one of several tests that the organization avoids private foundation status6 Non-operating private foundations non. A less common type of private foundation is a private operating foundation. In 2008 of which 110099 were grantmaking non-operating and 5241 were operating foundations. Ancient book that Foundation donates to public library Hand-written manuscript of Authors first novel that Foundation donates to public library Basis zero.

Source: thegiin.org

Source: thegiin.org

Examples of private operating foundations include. The foundation may also be funded with a bequest from the donors will or trust or receive funds as the primary or secondary beneficiary of a qualified plan or IRAThe IRS reports that there were 115340 private foundations in the US. Because of this emphasis on charitable activities a private operating foundation receives many of the same tax benefits as a public charity without needing to adhere to the public support test requirements. Private operating foundations and private non-operating foundations are two categories within the umbrella of a private foundation. Independent foundations are not governed under a benefactor the benefactors family or a corporation like most other private foundation types.

Private non-operating foundation. Subclassification private operating foundation. The Foundation Center 2012. To qualify as an operating foundation specific rules in addition to the applicable rules for private. Examples of operating foundations.

Source: foundationsource.com

Source: foundationsource.com

International Tax Accountants Firm. To demonstrate that it is a private operating base an organization must meet an asset test support test or. It is intended as an overview of planning considerations and reference outline for the practitioner to help clients define and achieve their philanthropic goals2 II. A less common type of private foundation is a private operating foundation. In protecting donor intent operating foundations have one obvious advantage.

Source: thegiin.org

Source: thegiin.org

They can conduct their own direct charitable activities and make grants to individuals award scholarships make grants to international organizations that arent recognized as 501c. Unlike private foundations that are not operating a private operating foundation is required to spend a certain portion of its assets each year on charitable activities. Examples Private Non-Operating Foundation Famous Author makes donations to Smith Family Foundation a private non-operating foundation PNF. The foundation may also be funded with a bequest from the donors will or trust or receive funds as the primary or secondary beneficiary of a qualified plan or IRAThe IRS reports that there were 115340 private foundations in the US. Operating foundations and donor intent.

Source: pinterest.com

Source: pinterest.com

Independent foundations are not governed under a benefactor the benefactors family or a corporation like most other private foundation types. Current value 15000. In exchange the private operating foundation allows public charity levels of deductibility for. Download all available information for this organization plus form 990 pdf files to your computer laptop and phone. Instead endowments fund independent foundations through a single source like an individual or.

Source: 501c3.org

Source: 501c3.org

A less common type of private foundation is a private operating foundation. A private operating foundation is a private foundation that conducts charitable activities as opposed to solely making charitable grants. Current value 15000. Typically a private foundation derives its endowment from a single sourcean original wealth creator a family or a corporation. Authority is vested in a board of trustees working in compliance with state and federal laws in addition to the philanthropys own bylaws trust agreement or articles of incorporation.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title private operating foundation examples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.