Your Long term disability lump sum examples images are ready in this website. Long term disability lump sum examples are a topic that is being searched for and liked by netizens now. You can Get the Long term disability lump sum examples files here. Find and Download all free images.

If you’re searching for long term disability lump sum examples pictures information related to the long term disability lump sum examples interest, you have pay a visit to the right blog. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

Long Term Disability Lump Sum Examples. For instance most long-term disability insurance policies require you to be disabled from your own occupation during the first two years. Attorney Victor Peña of Victor Peña Law PLLC successfully negotiated a lump sum buyout for a claimant who had no luck securing a disability settlement with his former attorneys. When settling lump-sum payments under a group disability policy there are multiple factors to be considered. 1 Many people who are awarded SSDI benefits receive a lump-sum payment to cover back pay for the months between their official date of disability onset and when they were finally awarded benefits.

Lump Sum Disability Buyout Calculator Ortiz Law Firm National Disability Attorneys From nickortizlaw.com

Lump Sum Disability Buyout Calculator Ortiz Law Firm National Disability Attorneys From nickortizlaw.com

In exchange for a lump sum buyout you agree to forgo monthly benefits and cancel your disability insurance policy. The lump sum repayment does not show up on the W2 from the Insurance Company. Each long term disability insurance company has its own protocol on buyouts. If we assume a 5 percent interest rate the present value of your lump-sum payment would be 450000. After that you usually must show that you cannot work at any gainful occupation. I read a similar post regarding a Claim of Right which I think applies.

Lump-sum offers are always discounted to todays dollars.

As a way to save money. 1 Many people who are awarded SSDI benefits receive a lump-sum payment to cover back pay for the months between their official date of disability onset and when they were finally awarded benefits. Long term disability insurance provides the needed safety net to protect against disabling injury or illness. A lump sum settlement is when your insurance company offers to pay you your future long-term disability benefits in one lump sum now rather than continuing to send you monthly benefits. In litigation arising out of Long Term Disability contracts LTD or Statutory Accident Benefits disputes in automobile accidents courts have declined to order or award a lump sum amount in lieu of the declaration of ongoing entitlement with a discount for present value calculations of future entitlements reduced by relevant contingencies such as prospects. I read a similar post regarding a Claim of Right which I think applies.

Source: pinterest.com

Source: pinterest.com

Some of that big check however may be going back to Uncle Sam as taxes. If you accept such a settlement you will not. I started receiving Long Term Disability benefits from an Insurance Co. There are some long-term disability insurance companies who buy out claimants just to get them off the. So it pays income replacement benefits to eligible people who suffer from a long-term disability as defined by the policy.

Source: cck-law.com

Source: cck-law.com

Attorney Victor Peña of Victor Peña Law PLLC successfully negotiated a lump sum buyout for a claimant who had no luck securing a disability settlement with his former attorneys. When settling lump-sum payments under a group disability policy there are multiple factors to be considered. This 49-year-old former employee of a major American media conglomerate had become frustrated dealing with Hartford. I started receiving Long Term Disability benefits from an Insurance Co. An insurers underlying reason for the offer is always to save money.

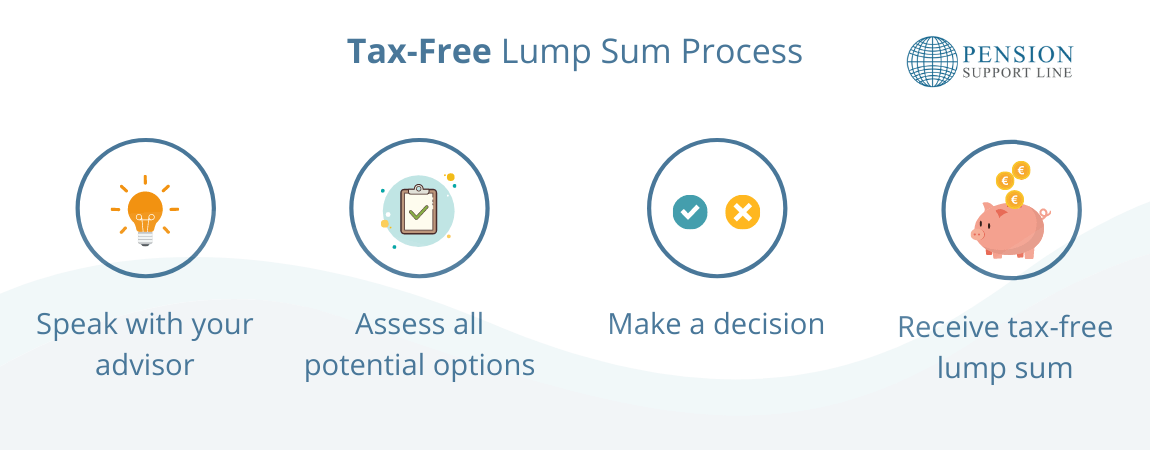

Source: pensionsupportline.ie

Source: pensionsupportline.ie

Claimants need to know that there are opportunities available with some companies but not with others to receive buyouts. For example if your policy provides for a minimum benefit of the greater of 100 or 10 of your gross monthly benefit and your gross long-term disability benefit is 2000 per month while you receive 2100 in other income benefits your net LTD benefit will be 200. As a result you will receive 120 more monthly payments on your individual or group long-term disability claim totaling 360000. It generally takes 3-5 months. Lump sum buyouts of long-term disability policies can happen at any particular time during the course of a claim.

Source: pinterest.com

Source: pinterest.com

As a simple example if youre receiving 1000month in disability benefits and your waiting period was 10 months your disability backpay would be 10000. But there are exclusions and rules that are. For instance most long-term disability insurance policies require you to be disabled from your own occupation during the first two years. I started receiving Long Term Disability benefits from an Insurance Co. An insurers underlying reason for the offer is always to save money.

Source: peacelawfirm.com

Source: peacelawfirm.com

In addition many policies replace the income that is lost if you have to take a lower-paying job due to an injury or illness. Partial permanent disability examples. There are time limitations in most ERISA long-term disability policies. This is common in workplace group benefits plans. As a simple example if youre receiving 1000month in disability benefits and your waiting period was 10 months your disability backpay would be 10000.

Source: pinterest.com

Source: pinterest.com

When settling lump-sum payments under a group disability policy there are multiple factors to be considered. Normally the first step would be calculating a claimants arrears and prejudgment interest. If you accept such a settlement you will not. A lump sum buyout is the payment of funds in exchange for the surrender of ones long term disability policy. Hartford is notorious for their unreasonable tactics in evaluating Long Term Disability claims.

Source: pinterest.com

Source: pinterest.com

I started receiving Long Term Disability benefits from an Insurance Co. This equates to receiving 5000 a month over the next 180 months. In addition many policies replace the income that is lost if you have to take a lower-paying job due to an injury or illness. The net present value NPV of your future benefits. First of all you should bear in mind that in order for the situation you are considering to arise.

Source: diattorney.com

Source: diattorney.com

In 2021 I was approved for SSDI benefits and they gave me a lump sum which I in turn gave to the Insurance Co. Long term disability insurance provides the needed safety net to protect against disabling injury or illness. If for example your monthly benefit is 3000 and you have 15 years until benefits end the full value of your long-term disability benefits would be 540000 300 x 12 x 15. Specifically its one of the only providers that engage in what is known as a lump sum disability buyout. In exchange for a lump sum buyout you agree to forgo monthly benefits and cancel your disability insurance policy.

Source: resolutelegal.ca

Source: resolutelegal.ca

The lump sum repayment does not show up on the W2 from the Insurance Company. I started receiving Long Term Disability benefits from an Insurance Co. For instance most long-term disability insurance policies require you to be disabled from your own occupation during the first two years. If for example your monthly benefit is 3000 and you have 15 years until benefits end the full value of your long-term disability benefits would be 540000 300 x 12 x 15. First of all you should bear in mind that in order for the situation you are considering to arise.

Source: rsmcanada.com

Source: rsmcanada.com

When settling lump-sum payments under a group disability policy there are multiple factors to be considered. If we assume a 5 percent interest rate the present value of your lump-sum payment would be 450000. Lump-sum offers are always discounted to todays dollars. In addition many policies replace the income that is lost if you have to take a lower-paying job due to an injury or illness. As a result you will receive 120 more monthly payments on your individual or group long-term disability claim totaling 360000.

Source:

Source:

1 Many people who are awarded SSDI benefits receive a lump-sum payment to cover back pay for the months between their official date of disability onset and when they were finally awarded benefits. Your clients monthly earnings are 10000 and therefore the monthly benefit is 60 or 6000 per month. Generally long term disability policies can replace anywhere from 60 percent to 80 percent of your income. Some of that big check however may be going back to Uncle Sam as taxes. This is a much higher level of proof.

Source: pensionsupportline.ie

Source: pensionsupportline.ie

Long-term disability insurance protects people from the risk of becoming unable to work. What that means for policyholders can be complicated as revealed by disability insurance lawyer Gregory Dell from. Lump-sum offers are always discounted to todays dollars. Hartford is notorious for their unreasonable tactics in evaluating Long Term Disability claims. First of all you should bear in mind that in order for the situation you are considering to arise.

Source: frankelnewfield.com

Source: frankelnewfield.com

There are time limitations in most ERISA long-term disability policies. The lump sum repayment does not show up on the W2 from the Insurance Company. By contrast long-term disability LTD benefits are paid by a private insurance company. You will no longer have an active disability claim with. A lump sum buyout is the payment of funds in exchange for the surrender of ones long term disability policy.

Source: cck-law.com

Source: cck-law.com

Lump-sum offers are always discounted to todays dollars. There are some long-term disability insurance companies who buy out claimants just to get them off the. For example imagine the future value of your policy over the next 15 years is 900000. As a way to save money. In addition many policies replace the income that is lost if you have to take a lower-paying job due to an injury or illness.

Source: enjuris.com

Source: enjuris.com

Hartford is notorious for their unreasonable tactics in evaluating Long Term Disability claims. This lump sum is equal to your approved monthly disability payment multiplied by the number of months the SSA determines you were waiting for an approval. When you qualify for Social Security disability you may receive a lump sum payment to cover the back benefits from your disability onset date. If you accept such a settlement you will not. If for example your monthly benefit is 3000 and you have 15 years until benefits end the full value of your long-term disability benefits would be 540000 300 x 12 x 15.

Source: nickortizlaw.com

Source: nickortizlaw.com

As a result you will receive 120 more monthly payments on your individual or group long-term disability claim totaling 360000. You expect to remain disabled and unable to work until age 65. I started receiving Long Term Disability benefits from an Insurance Co. This is common in workplace group benefits plans. You will no longer have an active disability claim with.

Source: disabilitydenials.com

Source: disabilitydenials.com

An insurers underlying reason for the offer is always to save money. You have just settled your clients long-term disability case. This means that if you invested that 450000 and. In litigation arising out of Long Term Disability contracts LTD or Statutory Accident Benefits disputes in automobile accidents courts have declined to order or award a lump sum amount in lieu of the declaration of ongoing entitlement with a discount for present value calculations of future entitlements reduced by relevant contingencies such as prospects. Lump-sum offers are always discounted to todays dollars.

Source: pinterest.com

Source: pinterest.com

An insurers underlying reason for the offer is always to save money. When settling lump-sum payments under a group disability policy there are multiple factors to be considered. Each long term disability insurance company has its own protocol on buyouts. If we assume a 5 percent interest rate the present value of your lump-sum payment would be 450000. Generally long term disability policies can replace anywhere from 60 percent to 80 percent of your income.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title long term disability lump sum examples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.