Your Going concern memo example images are available in this site. Going concern memo example are a topic that is being searched for and liked by netizens today. You can Get the Going concern memo example files here. Get all royalty-free photos and vectors.

If you’re searching for going concern memo example images information linked to the going concern memo example keyword, you have visit the ideal blog. Our website always gives you hints for seeking the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

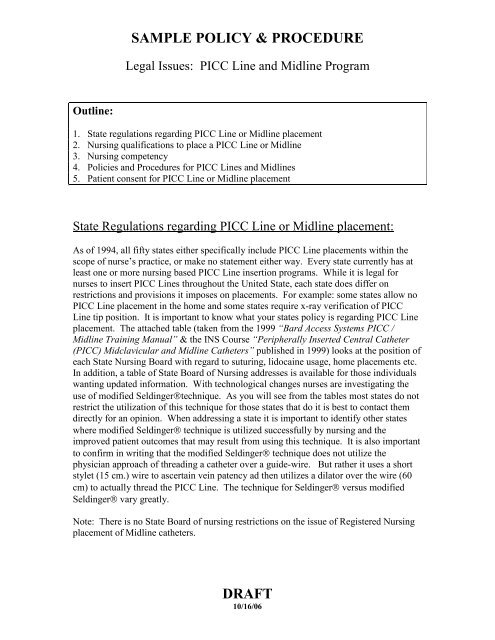

Going Concern Memo Example. Going Concern Discussion Memorandum ARSC Meeting May 9-11 2017 Agenda Item 4 Page 3 of 11 o A going concern emphasis-of-matter paragraph was included in the prior years auditors report and the conditions or events giving rise to the emphasis-of. AR-C 90A123 provides the following example of a going concern paragraph in a review engagement when 1 substantial doubt exists for a reasonable period of time 2 managements plans dont alleviate the substantial doubt and 3 the reporting framework requires a. For more information contact your BKD advisor. This SAS is effective for audits of financial statements for periods ending on or after December 15 2017.

When assessing a companys ability to continue as a. ASU 2014-15 Presentation of Financial StatementsGoing Concern Subtopic 205-40 Disclosure of Uncertainties about an Entitys Ability to Continue as a Going Concern requires management to prepare an assessment of its Companys presumed ability to continue as a going concern. In step 2 of the going-concern assessment an entity must apply the guidance in ASC 205-40-50-6 which requires the entity to evaluate whether its plans that are intended to mitigate the conditions and events identified in step 1 when implemented will alleviate substantial doubt about the entitys ability to continue as a going concern. An example of the emphasis paragraph in those circumstances is provided as application material. EXAMPLE MEMO EFFECT ON GOING CONCERN Going concern memo Going concern The Company has shown recoveries in operations in the year ended December 31 20XX. ICAI guidance on going concern.

Memorandum Statement on Auditing.

EXAMPLE MEMO EFFECT ON GOING CONCERN Going concern memo Going concern The Company has shown recoveries in operations in the year ended December 31 20XX. For example debt classified as long-term may be due within 12 months after the financial statement issuance date and thus within the scope of a going concern evaluation. Going Concern Discussion Memorandum ARSC Meeting May 9-11 2017 Agenda Item 4 Page 3 of 11 o A going concern emphasis-of-matter paragraph was included in the prior years auditors report and the conditions or events giving rise to the emphasis-of. Connie Spinelli CPA. QAs interpretive guidance and illustrative examples include insights into how continued economic uncertainty may affect going concern assessments. Going concern assessment Management considerations Source.

Source: pinterest.com

Source: pinterest.com

EXAMPLE MEMO EFFECT ON GOING CONCERN Going concern memo Going concern The Company has shown recoveries in operations in the year ended December 31 20XX. Auditing standards and federal securities law require that an auditor evaluate whether there is substantial doubt about an entitys ability to continue as a going concern for a reasonable period of time not to exceed one year beyond the date of the financial statements being. Most stakeholders are familiar with the specific discussion of going concern and related requirements in IAS 1 Presentation of Financial Statements to disclose material uncertainties relating to an entitys ability to continue as a going concern. Few examples are highlighted in the table below. Interim financial statement requirements ASU 2014-15 requires management to assess an entitys ability as a going concern for each interim reporting period.

Source: pinterest.com

Source: pinterest.com

The Seller s audited financial statements delivered to Buyer shall contain an audit opinion that is qualified or limited by reference to the status of Seller as a going concern or reference of similar import. Auditing standards and federal securities law require that an auditor evaluate whether there is substantial doubt about an entitys ability to continue as a going concern for a reasonable period of time not to exceed one year beyond the date of the financial statements being. Going concern basis of accounting when relevant in the preparation of the financial statements and 2 based on the audit evidence. The evaluation of the presumption should identify relevant. SAS 132 amends SAS 126 The Auditors Consideration of.

Source: pinterest.com

Source: pinterest.com

QAs interpretive guidance and illustrative examples include insights into how continued economic uncertainty may affect going concern assessments. Connie Spinelli CPA. Auditors will use SAS 132 The Auditors Consideration of an Entitys Ability to Continue as a Going Concern to make going concern decisions. The letter below is provided as an example of the type of letter to be obtained to confirm the management representations provided to the auditor during the course of the audit assignment. An example of the emphasis paragraph in those circumstances is provided as application material.

EoM paragraph in relation to the going concern assumption9. Auditors will use SAS 132 The Auditors Consideration of an Entitys Ability to Continue as a Going Concern to make going concern decisions. The evaluation of the presumption should identify relevant. EoM paragraph in relation to the going concern assumption9. Few examples are highlighted in the table below.

Source: pinterest.com

Source: pinterest.com

EXAMPLE MEMO EFFECT ON GOING CONCERN Going concern memo Going concern The Company has shown recoveries in operations in the year ended December 31 20XX. Auditing standards and federal securities law require that an auditor evaluate whether there is substantial doubt about an entitys ability to continue as a going concern for a reasonable period of time not to exceed one year beyond the date of the financial statements being. EoM paragraph in relation to the going concern assumption9. For example debt classified as long-term may be due within 12 months after the financial statement issuance date and thus within the scope of a going concern evaluation. Examples for reporting the impact of COVID-19 on going concern and subsequent events in financial statements July 2020 Insights by Capital Markets Accounting Advisory Services CMAAS 1 At a glance.

Source: pinterest.com

Source: pinterest.com

Going concern basis may therefore involve a greater degree of judgement than is usual. A going concern or to provide related footnote disclosures. Memorandum Statement on Auditing. QAs interpretive guidance and illustrative examples include insights into how continued economic uncertainty may affect going concern assessments. This may result in situations where the auditors going concern evaluation is for a period of time that is less than managements evaluation period.

Source: pinterest.com

Source: pinterest.com

Memorandum Statement on Auditing. Going concern basis may therefore involve a greater degree of judgement than is usual. KPMG explains how an entitys management performs a going concern assessment and makes appropriate disclosures. The letter will require to be amended to reflect the actual representations that are to be confirmed in each audit assignment. Auditing standards and federal securities law require that an auditor evaluate whether there is substantial doubt about an entitys ability to continue as a going concern for a reasonable period of time not to exceed one year beyond the date of the financial statements being.

Source: pinterest.com

Source: pinterest.com

A going concern or to provide related footnote disclosures. SAS 132 amends SAS 126 The Auditors Consideration of. In step 2 of the going-concern assessment an entity must apply the guidance in ASC 205-40-50-6 which requires the entity to evaluate whether its plans that are intended to mitigate the conditions and events identified in step 1 when implemented will alleviate substantial doubt about the entitys ability to continue as a going concern. ASU 2014-15 Presentation of Financial StatementsGoing Concern Subtopic 205-40 Disclosure of Uncertainties about an Entitys Ability to Continue as a Going Concern requires management to prepare an assessment of its Companys presumed ability to continue as a going concern. Cases where greater audit testing would appear likely to have resolved instances of going concern uncertainty.

Source: pinterest.com

Source: pinterest.com

Memorandum Statement on Auditing. Going concern basis of accounting when relevant in the preparation of the financial statements and 2 based on the audit evidence. For example debt classified as long-term may be due within 12 months after the financial statement issuance date and thus within the scope of a going concern evaluation. EXAMPLE MEMO EFFECT ON GOING CONCERN Going concern memo Going concern The Company has shown recoveries in operations in the year ended December 31 20XX. QAs interpretive guidance and illustrative examples include insights into how continued economic uncertainty may affect going concern assessments.

Source: pinterest.com

Source: pinterest.com

Nevertheless to meet the requirement of ISA 570 Revised Going Concern the auditor will need to evaluate management s assessment and be satisfied through discussion inquiry and inspection of supporting documentation that the going concern assumption is appropriate. For more information contact your BKD advisor. Going concern assessment Management considerations Source. Statements Going Concern in preparing financial statements for each annual and interim reporting period management must evaluate whether there are conditions and events that raise substantial doubt about an entitys ability to continue as a going concern within one year after the date the financial. Nevertheless to meet the requirement of ISA 570 Revised Going Concern the auditor will need to evaluate management s assessment and be satisfied through discussion inquiry and inspection of supporting documentation that the going concern assumption is appropriate.

Going concern adequacy of related disclosures in the financial statements and implications on the. Auditing standards and federal securities law require that an auditor evaluate whether there is substantial doubt about an entitys ability to continue as a going concern for a reasonable period of time not to exceed one year beyond the date of the financial statements being. Cases where greater audit testing would appear likely to have resolved instances of going concern uncertainty. This SAS is effective for audits of financial statements for periods ending on or after December 15 2017. See our Guide to annual financial statements COVID-19 supplement which illustrates possible examples of going concern and liquidity risk disclosures.

Source: pinterest.com

Source: pinterest.com

Going concern basis may therefore involve a greater degree of judgement than is usual. AR-C 90A123 provides the following example of a going concern paragraph in a review engagement when 1 substantial doubt exists for a reasonable period of time 2 managements plans dont alleviate the substantial doubt and 3 the reporting framework requires a. SAS 132 amends SAS 126 The Auditors Consideration of. Going concern basis of accounting when relevant in the preparation of the financial statements and 2 based on the audit evidence. The pace was modest but was parallel to the overall economic recovery.

Source: pinterest.com

Source: pinterest.com

Going Concern Discussion Memorandum ARSC Meeting May 9-11 2017 Agenda Item 4 Page 3 of 11 o A going concern emphasis-of-matter paragraph was included in the prior years auditors report and the conditions or events giving rise to the emphasis-of. The Seller s audited financial statements delivered to Buyer shall contain an audit opinion that is qualified or limited by reference to the status of Seller as a going concern or reference of similar import. Guarantors audited financial statements or notes. The evaluation of the presumption should identify relevant. Most stakeholders are familiar with the specific discussion of going concern and related requirements in IAS 1 Presentation of Financial Statements to disclose material uncertainties relating to an entitys ability to continue as a going concern.

Source: mailtoself.com

Source: mailtoself.com

KPMG explains how an entitys management performs a going concern assessment and makes appropriate disclosures. Managements Going Concern Responsibilities Defined. Auditing standards and federal securities law require that an auditor evaluate whether there is substantial doubt about an entitys ability to continue as a going concern for a reasonable period of time not to exceed one year beyond the date of the financial statements being. Actions for management to take now. Auditors will use SAS 132 The Auditors Consideration of an Entitys Ability to Continue as a Going Concern to make going concern decisions.

Source: in.pinterest.com

Source: in.pinterest.com

Auditing standards and federal securities law require that an auditor evaluate whether there is substantial doubt about an entitys ability to continue as a going concern for a reasonable period of time not to exceed one year beyond the date of the financial statements being. EXAMPLE MEMO EFFECT ON GOING CONCERN Going concern memo Going concern The Company has shown recoveries in operations in the year ended December 31 20XX. Going Concern Auditing Standard. Nevertheless to meet the requirement of ISA 570 Revised Going Concern the auditor will need to evaluate management s assessment and be satisfied through discussion inquiry and inspection of supporting documentation that the going concern assumption is appropriate. QAs interpretive guidance and illustrative examples include insights into how continued economic uncertainty may affect going concern assessments.

Source: pinterest.com

Source: pinterest.com

This SAS is effective for audits of financial statements for periods ending on or after December 15 2017. SAS 132 amends SAS 126 The Auditors Consideration of. Companys ability to continue as a going concern. Nevertheless to meet the requirement of ISA 570 Revised Going Concern the auditor will need to evaluate management s assessment and be satisfied through discussion inquiry and inspection of supporting documentation that the going concern assumption is appropriate. Cases where greater audit testing would appear likely to have resolved instances of going concern uncertainty.

Source: pinterest.com

Source: pinterest.com

When assessing a companys ability to continue as a. Cases where greater audit testing would appear likely to have resolved instances of going concern uncertainty. This may result in situations where the auditors going concern evaluation is for a period of time that is less than managements evaluation period. Guarantors audited financial statements or notes. In step 2 of the going-concern assessment an entity must apply the guidance in ASC 205-40-50-6 which requires the entity to evaluate whether its plans that are intended to mitigate the conditions and events identified in step 1 when implemented will alleviate substantial doubt about the entitys ability to continue as a going concern.

Source: pinterest.com

Source: pinterest.com

KPMG explains how an entitys management performs a going concern assessment and makes appropriate disclosures. SAS 132 amends SAS 126 The Auditors Consideration of. Going Concern Evaluation Checklist This five-step checklist is intended to provide an example of questions for management to consider when performing its evaluation of an entitys ability to continue as a going concern. A going concern or to provide related footnote disclosures. This may result in situations where the auditors going concern evaluation is for a period of time that is less than managements evaluation period.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title going concern memo example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.