Your Cash secured put example images are available. Cash secured put example are a topic that is being searched for and liked by netizens today. You can Get the Cash secured put example files here. Find and Download all royalty-free photos.

If you’re looking for cash secured put example pictures information related to the cash secured put example keyword, you have come to the right blog. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

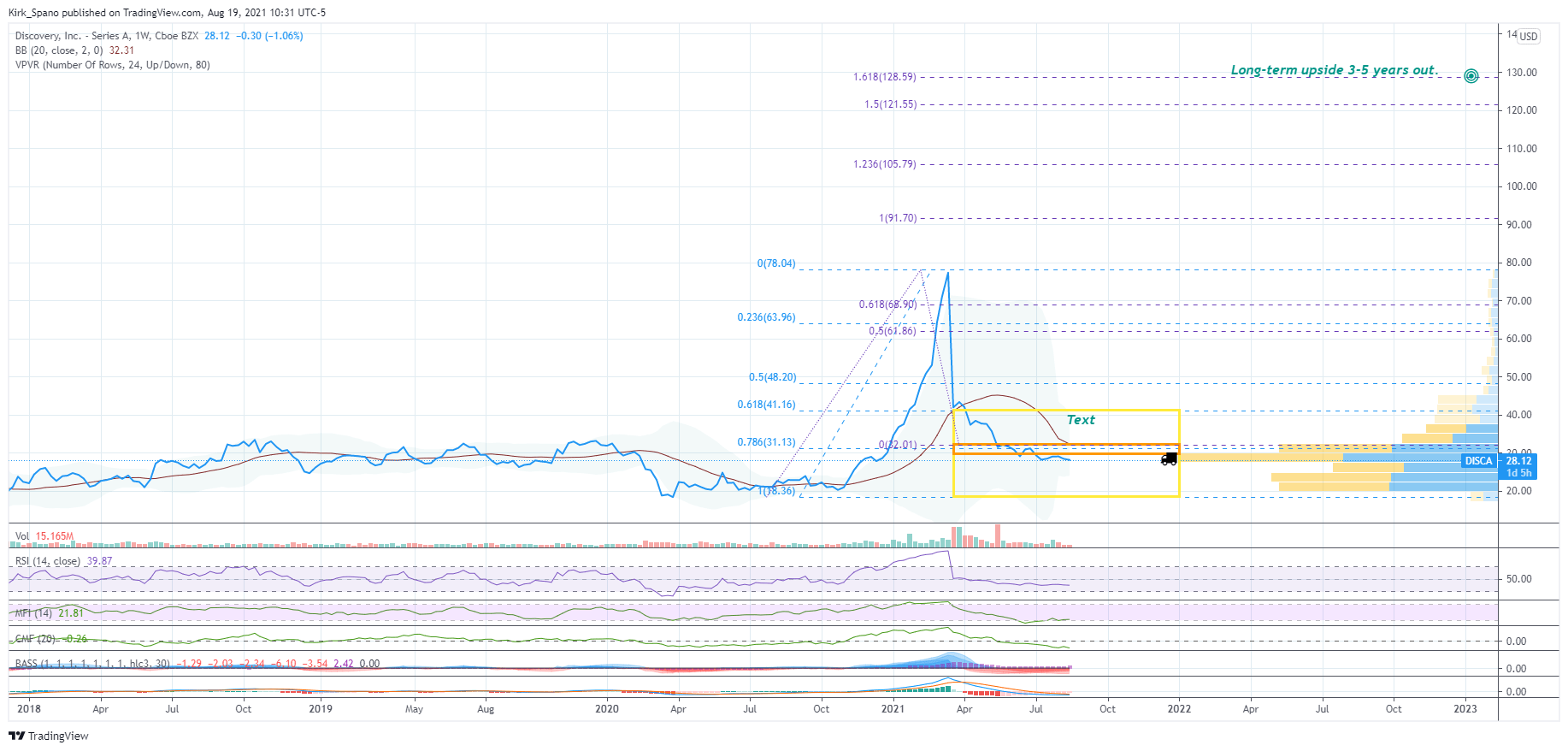

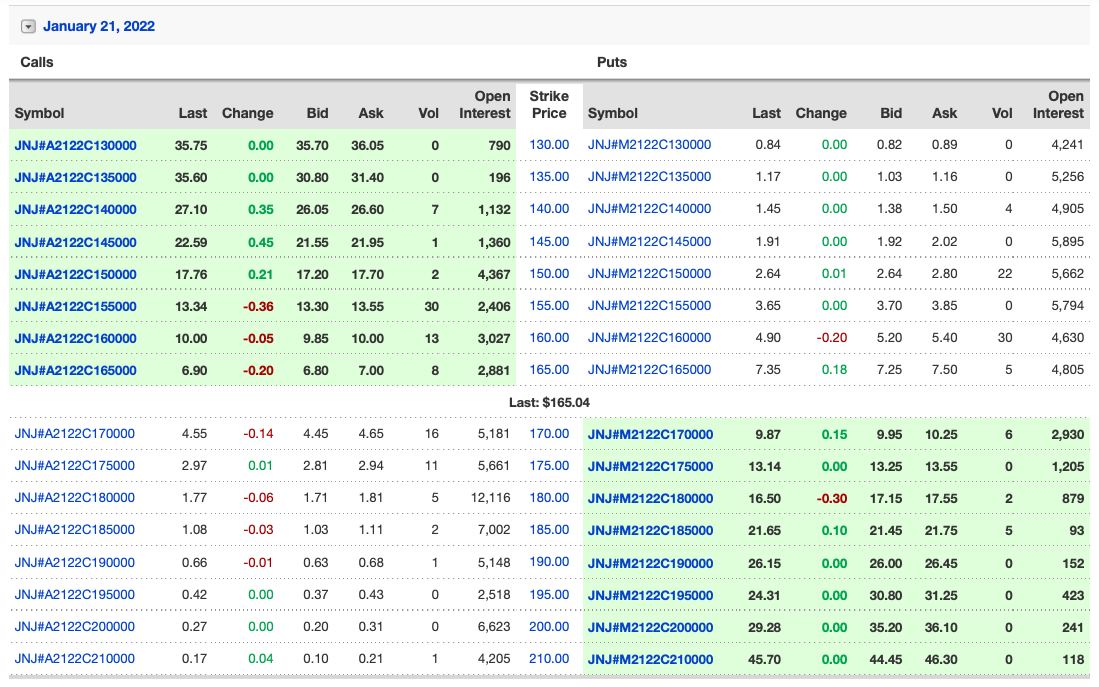

Cash Secured Put Example. Berkshire Hathaway BRKB The next example of a cash secured put strategy that were going to explore is for Berkshire Hathaways class B. It showed selling cash-secured puts. Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership. If the investor was.

Selling Put Options Tutorial Examples From lynalden.com

Selling Put Options Tutorial Examples From lynalden.com

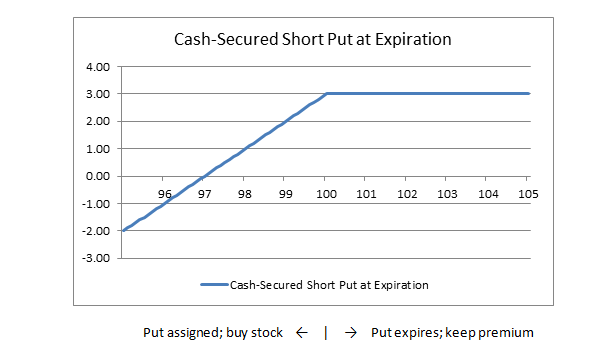

With IBKR currently trading at 4325 an investor might. Starting with the chart above on Friday Sept. Like Comment and Share my videos SUBSCRIBE HERE httpbitlyBroeSubscribe LETS CONNECT Instagram JakeBroe httpswwwinstagram. Based on the service model the same or similar products. Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership. It showed selling cash-secured puts.

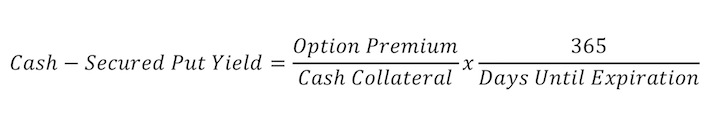

If you sell that cash-secured put option for a strike price of 30 youll receive 550 in premiums per share and it will expire in 13 months.

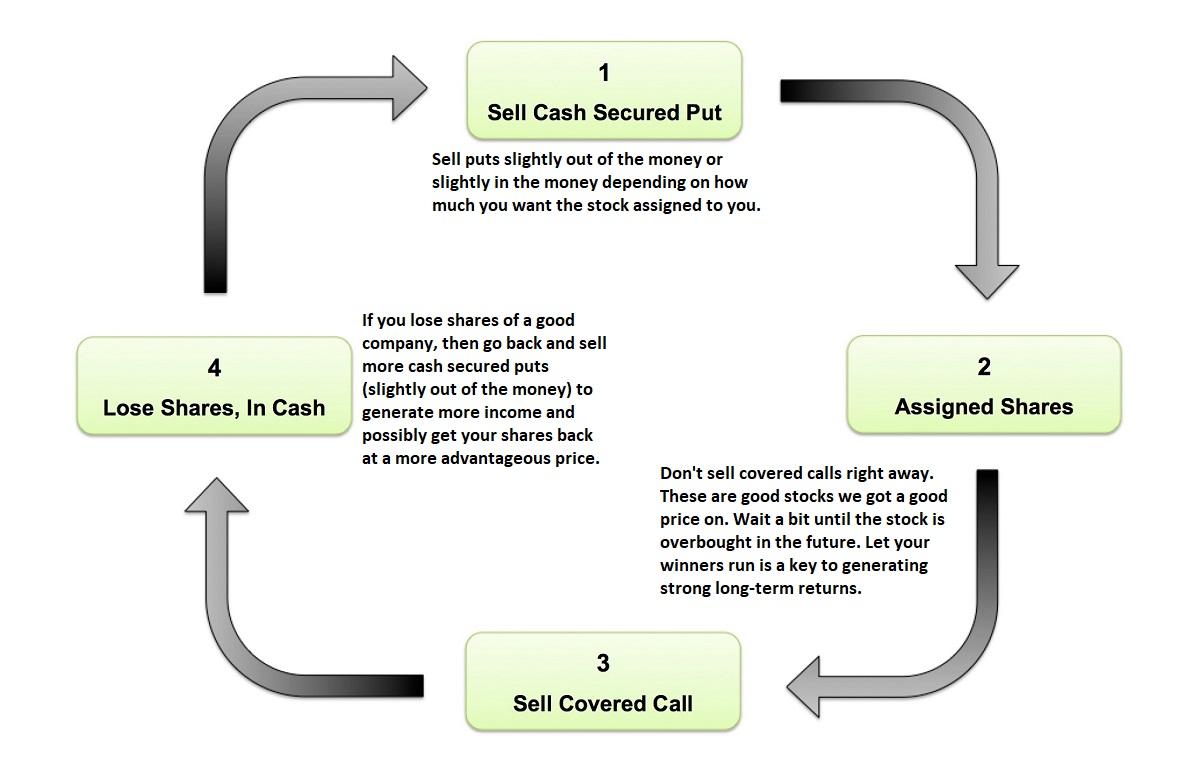

Cash Secured Put example. This post may contain affiliate links. Cash Secured Puts are the other side of the strategy that I use when buying stocks. Like Comment and Share my videos SUBSCRIBE HERE httpbitlyBroeSubscribe LETS CONNECT Instagram JakeBroe httpswwwinstagram. The Options Strategies Cash-Secured Put. Designed to generate short-term income or purchase desired stocks at a favorable price writing cash-secured equity puts or CSEPs is a.

Source: investopedia.com

Source: investopedia.com

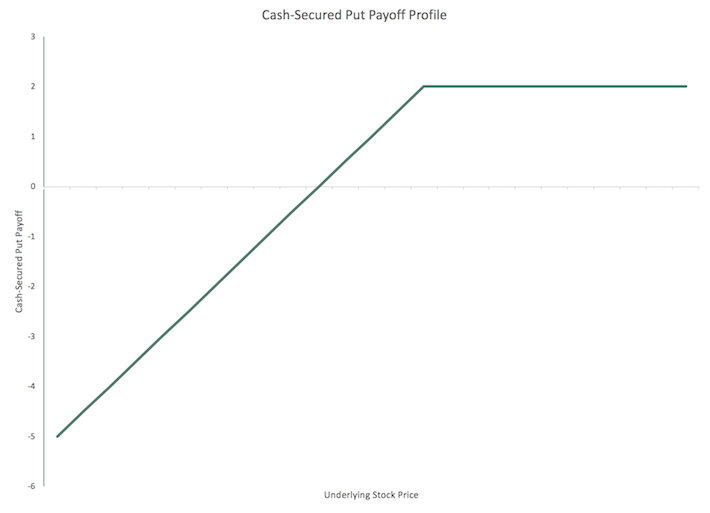

If the stock price goes up to over 30 by. If the investor was. Heres an example of a cash-covered put in action. This graph shows profit and loss of long stock and the short put. Does the money used as collateral immediately return to your.

Source: tdameritrade.com.sg

Source: tdameritrade.com.sg

It showed selling cash-secured puts. Sell 1 XYZ Dec 50 put 230 to open. If the investor was. Now lets talk about the difference between cash-secured puts and naked puts. Products accounts and services are offered through different service models for example self-directed full-service.

Source: investopedia.com

Source: investopedia.com

Once we have selected an elite. With IBKR currently trading at 4325 an investor might. The Options Strategies Cash-Secured Put. I will go into the entire strategy in a near-future post but I thought I would give you guys. The Differences Between Cash Secured vs Naked Puts.

Source: seekingalpha.com

Source: seekingalpha.com

A cash secured put is a conservative options strategy that can be used to purchase a stock for lower than the current price. The cash-secured put involves writing an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock. You dont mind buying DBX at 18 so you decide to sell one Put 18 expiring in two months for 1 premium. Understanding Cash-Secured Puts. Designed to generate short-term income or purchase desired stocks at a favorable price writing cash-secured equity puts or CSEPs is a.

Source: suredividend.com

Source: suredividend.com

Selling cash-secured puts is arguably a very lucrative strategy. Stock or ETF selection option selection and position management. Selling the put obligates you to buy. 0 Cash Secured Put Example. We discussed its mechanism as well as walked though a real-life example.

Source: youtube.com

Source: youtube.com

Sell 1 XYZ Dec 50 put 230 to open. INTC Cash Secured Put Example. This graph shows profit and loss of long stock and the short put. Once we have selected an elite. A cash secured put is a conservative options strategy that can be used to purchase a stock for lower than the current price.

Source: suredividend.com

Source: suredividend.com

Heres an example of a cash-covered put in action. Heres an example of a cash-covered put in action. Does the money used as collateral immediately return to your. Cash Secured Puts are the other side of the strategy that I use when buying stocks. Sell 1 XYZ Dec 50 put 230 to open.

Source: lynalden.com

Source: lynalden.com

If you keep enough cash on hand not only are you prepared in the event of an assignment but youve tapped into a method to buy stock that. Please read our disclosure for more info. For cash secured puts does Fidelity deduct the cost of assignment from your purchasing power the moment you write a CSP. The Differences Between Cash Secured vs Naked Puts. If you keep enough cash on hand not only are you prepared in the event of an assignment but youve tapped into a method to buy stock that.

Source: optionsplaybook.com

Source: optionsplaybook.com

Cash Secured Put example. Cash secured puts mean that you have. Products accounts and services are offered through different service models for example self-directed full-service. I will go into the entire strategy in a near-future post but I thought I would give you guys. When we sell cash-secured puts we must use all 3 of our required skills.

Source: chase.com

Source: chase.com

In other words youre selling 1 contract 100 shares on stock. Based on the service model the same or similar products. If you keep enough cash on hand not only are you prepared in the event of an assignment but youve tapped into a method to buy stock that. This graph shows profit and loss of long stock and the short put. For cash secured puts does Fidelity deduct the cost of assignment from your purchasing power the moment you write a CSP.

Source: youtube.com

Source: youtube.com

The goal is to be assigned and. Understanding Cash-Secured Puts. Cash Secured Put Example 3. The goal is to be assigned and. Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership.

Source: seekingalpha.com

Source: seekingalpha.com

If the investor was. Does the money used as collateral immediately return to your. For cash secured puts does Fidelity deduct the cost of assignment from your purchasing power the moment you write a CSP. This graph shows profit and loss of long stock and the short put. If you keep enough cash on hand not only are you prepared in the event of an assignment but youve tapped into a method to buy stock that.

Source: investopedia.com

Source: investopedia.com

Once we have selected an elite. Please read our disclosure for more info. The Differences Between Cash Secured vs Naked Puts. Cash Secured Puts are the other side of the strategy that I use when buying stocks. If the investor was.

Source: youtube.com

Source: youtube.com

When we sell cash-secured puts we must use all 3 of our required skills. Products accounts and services are offered through different service models for example self-directed full-service. With IBKR currently trading at 4325 an investor might. Like Comment and Share my videos SUBSCRIBE HERE httpbitlyBroeSubscribe LETS CONNECT Instagram JakeBroe httpswwwinstagram. Cash Secured Put example.

Source: fidelity.com

Source: fidelity.com

With IBKR currently trading at 4325 an investor might. It showed selling cash-secured puts. Sell 1 XYZ Dec 50 put 230 to open. Stock or ETF selection option selection and position management. Selling Cash Secured Puts.

Designed to generate short-term income or purchase desired stocks at a favorable price writing cash-secured equity puts or CSEPs is a. With IBKR currently trading at 4325 an investor might. DBX is currently trading at 20. Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership. Now lets talk about the difference between cash-secured puts and naked puts.

Source: tdameritrade.com.sg

Source: tdameritrade.com.sg

Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership. Selling the put obligates you to buy. Based on the service model the same or similar products. In other words youre selling 1 contract 100 shares on stock. Heres an example of a cash-covered put in action.

Source: suredividend.com

Source: suredividend.com

The Options Strategies Cash-Secured Put. Cash secured puts mean that you have. I will go into the entire strategy in a near-future post but I thought I would give you guys. Selling Cash Secured Puts. You dont mind buying DBX at 18 so you decide to sell one Put 18 expiring in two months for 1 premium.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cash secured put example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.