Your Business interruption insurance claims examples images are available. Business interruption insurance claims examples are a topic that is being searched for and liked by netizens today. You can Find and Download the Business interruption insurance claims examples files here. Get all royalty-free vectors.

If you’re searching for business interruption insurance claims examples pictures information linked to the business interruption insurance claims examples interest, you have pay a visit to the ideal site. Our site frequently gives you suggestions for viewing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Business Interruption Insurance Claims Examples. Your Business Interruption Insurance covers the income lost when you were closed totalling 55000. Landlord shall use its best efforts to effect such repairs promptly. The suspension however must be caused by a covered cause that results in direct physical loss or damage to the property. For example you might have initially believed that your.

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com From irmi.com

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com From irmi.com

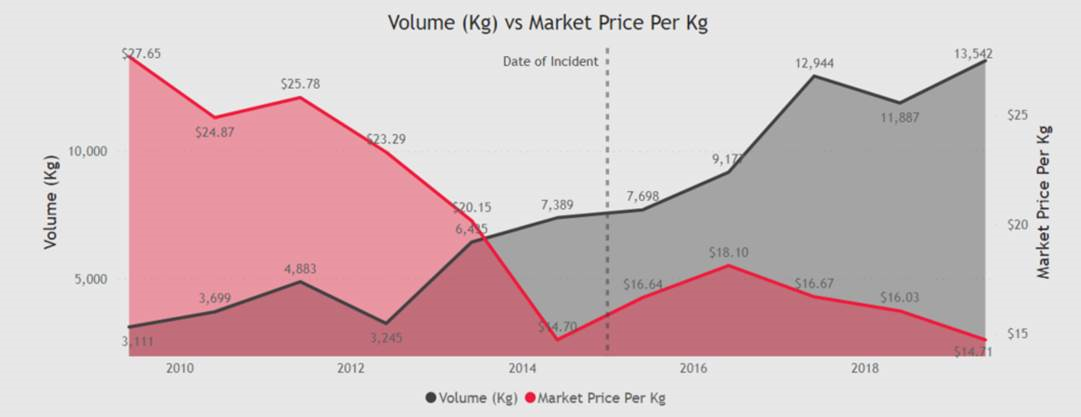

Commercial property insurance may cover the. Claims -basis of settlement A Loss of income The insurance by this item is limited to loss of income due to. The loss or damage must be caused by or. The LMI RiskCoach Hazard Rating Index Graph for a Clothing Retailer RISC Code 4251 0030. For example if a premises were to be flooded and the business was unable to operate as a consequence business interruption insurance would cover the financial losses incurred until the business was up and running and back. The intention of a BI policy is to maintain the turnover of the business during the indemnity period following an insured incident so that it can resume trading at its anticipated pre loss trading level.

Business owners thought they were covered for loss of income under the terms of their business interruption insurance policies.

Business interruption insurance is insurance coverage that replaces business income lost in a disaster. Suspension of the policyholders operations. Commercial property insurance may cover the. If youve purchased business interruption BI insurance and are planning to submit a claim for benefits or have already submitted a claim and have been denied then you may be feeling somewhat confused by the ambiguity of coverage and how that can be used by the insurance company to deny your claim. Therefore most policies require that your business property sustain physical loss or damage to be eligible. Thats because in almost all cases continuous revenue and cash flow without interruption is the lifeblood of SMEs.

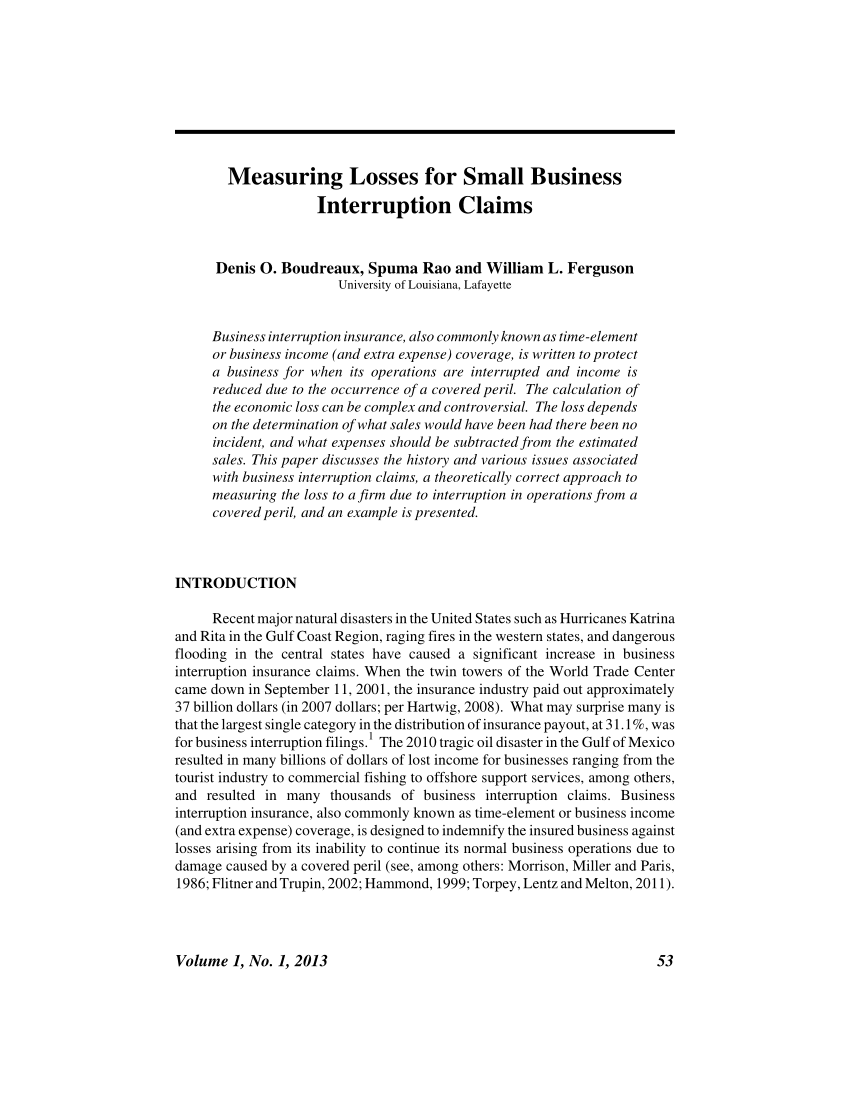

Source: researchgate.net

Source: researchgate.net

If youve purchased business interruption BI insurance and are planning to submit a claim for benefits or have already submitted a claim and have been denied then you may be feeling somewhat confused by the ambiguity of coverage and how that can be used by the insurance company to deny your claim. A perfect example would be that of the real estate company which specialized in converting distressed properties into successful timeshare propertiesa claim. Thats because in almost all cases continuous revenue and cash flow without interruption is the lifeblood of SMEs. The event could be for example a. This calculator supports the content with in our Finalised Guidance specifically Chapters 7 8 and 9.

Source: irmi.com

Source: irmi.com

The suspension however must be caused by a covered cause that results in direct physical loss or damage to the property. Because Dictiomatics business interruption. Thats because in almost all cases continuous revenue and cash flow without interruption is the lifeblood of SMEs. Insurance example above then goes on to set out further details about what type of events trigger the cover for interruption to business. Claims -basis of settlement A Loss of income The insurance by this item is limited to loss of income due to.

Therefore it is disappointing to us that at the time of writing less than half of the businesses in Australia and New Zealand have any form of Interruption Insurance. In basic terms business interruption insurance protects businesses against losses that arise due to a shutdown of a business as a result of damage caused by a covered event such as a fire hurricane or other natural disaster. The loss or damage must be caused by or. Insurance brokers and accountants can support in collating original documents demonstrating aspects such as the lost. A list of policies assessed by insurers as in principle capable of responding to Covid-19 as a result of the test case.

Source: slideshare.net

Source: slideshare.net

If youve purchased business interruption BI insurance and are planning to submit a claim for benefits or have already submitted a claim and have been denied then you may be feeling somewhat confused by the ambiguity of coverage and how that can be used by the insurance company to deny your claim. Suspension of the policyholders operations. For example if fire damage shuts down a factory the business income coverage usually pays for lost income until the damage can be repaired and production can be restored. Following a kitchen fire you have to close your cafe during restoration and repairs. Claims -basis of settlement A Loss of income The insurance by this item is limited to loss of income due to.

Source: strategic-insurance.com

Source: strategic-insurance.com

If youve purchased business interruption BI insurance and are planning to submit a claim for benefits or have already submitted a claim and have been denied then you may be feeling somewhat confused by the ambiguity of coverage and how that can be used by the insurance company to deny your claim. The results can be used to help make a claim under their business interruption insurance policy. Your Business Interruption Insurance covers the income lost when you were closed totalling 55000. A guide to business interruption insurance. A murder or suicide.

Source: sampleforms.com

Source: sampleforms.com

The results can be used to help make a claim under their business interruption insurance policy. An example includes the loss of revenue suffered after substantial property damage closes a business while the owner completes repairs. Because Dictiomatics business interruption. Most commercial property insurance covers business income loss by adding an addendum to the primary policy. Business interruption insurance can provide your business with ongoing income during a temporary closure.

Source: sgrlaw.com

Source: sgrlaw.com

Landlord shall use its best efforts to effect such repairs promptly. Suspension of the policyholders operations. One of your suppliers suffers a fire causing your shipments to be delayed and negatively impacts your income. Business Interruption Coverage Grant We will pay for the actual loss of Business Income you sustain due to the necessary suspension of your operations during the period of restoration The suspension must be caused by direct physical loss of or damage to property at the described premises in the Declarations. Affecting the business before or after the damage or which would have affected the business had the damage not occurred.

Source: bdo.com.au

Source: bdo.com.au

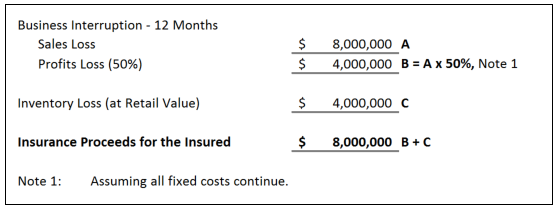

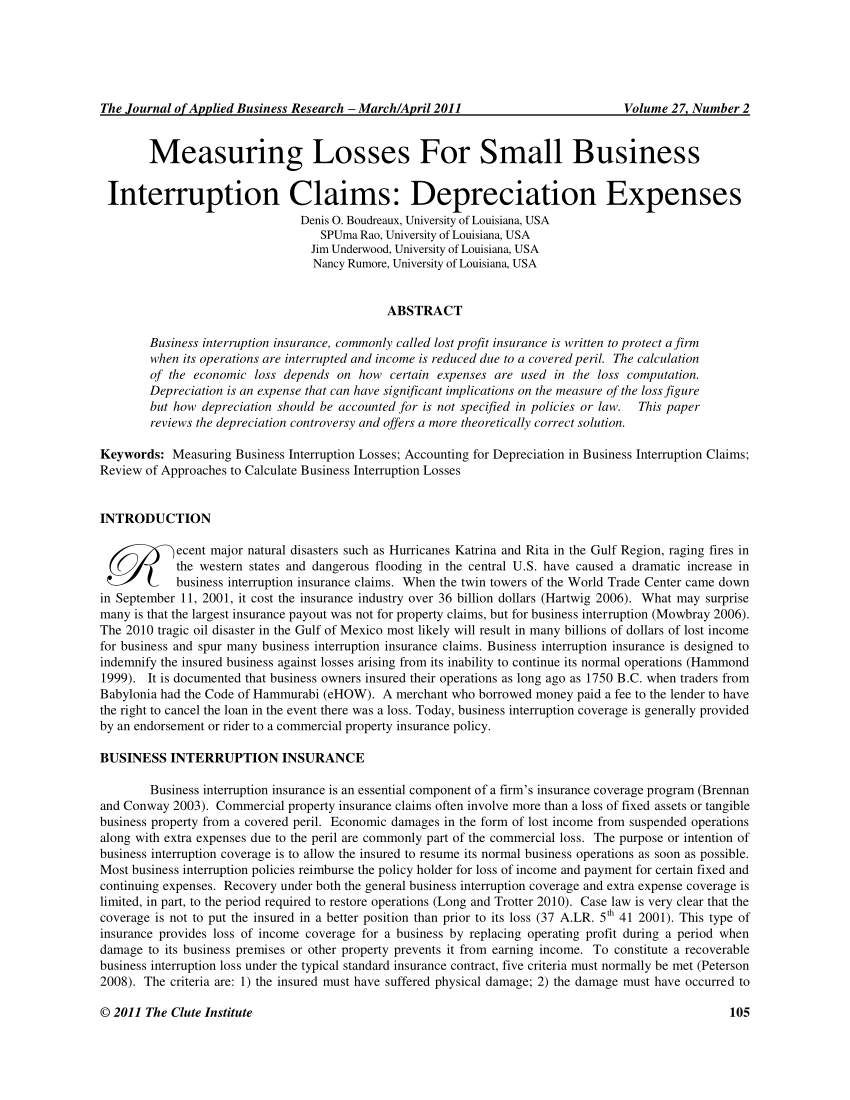

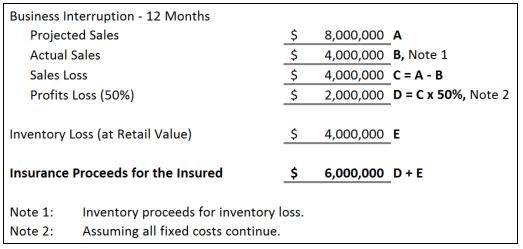

A reduction in incomeand b increase in cost of working and the amount payable will be. Thats because in almost all cases continuous revenue and cash flow without interruption is the lifeblood of SMEs. No damages compensation or claim shall be payable by Landlord for inconvenience loss of business or annoyance arising from any repair or restoration of any portion of the Premises the Building or the Project. Business interruption insurance is intended to return to the insureds business the amount of profit it would have earned had there been no interruption of the business. Business interruption insurance may not be used to put Dictiomatic in a better position than it would have occupied without the interruption.

Source: mdd.com

Source: mdd.com

The LMI RiskCoach Hazard Rating Index Graph for a Clothing Retailer RISC Code 4251 0030. Claims -basis of settlement A Loss of income The insurance by this item is limited to loss of income due to. Many insurers have claimed that the policies were not intended to cover outbreaks of epidemic diseases. Suspension of the policyholders operations. The suspension however must be caused by a covered cause that results in direct physical loss or damage to the property.

Source: researchgate.net

Source: researchgate.net

Claims -basis of settlement A Loss of income The insurance by this item is limited to loss of income due to. For example if a premises were to be flooded and the business was unable to operate as a consequence business interruption insurance would cover the financial losses incurred until the business was up and running and back. Business interruption claim examples business interruption insurance examples business interruption insurance explained business interruption insurance policy sample business interruption insurance lawsuit business interruption claim worksheet business interruption insurance worksheet business interruption insurance exclusions Glance through that even. Business Interruption Coverage Grant We will pay for the actual loss of Business Income you sustain due to the necessary suspension of your operations during the period of restoration The suspension must be caused by direct physical loss of or damage to property at the described premises in the Declarations. The italicised terms are subject to definition as.

Source: researchgate.net

Source: researchgate.net

Business interruption claim examples business interruption insurance examples business interruption insurance explained business interruption insurance policy sample business interruption insurance lawsuit business interruption claim worksheet business interruption insurance worksheet business interruption insurance exclusions Glance through that even. Nearly all of the claims have been met with letters of rejection from insurance companies. Business owners thought they were covered for loss of income under the terms of their business interruption insurance policies. An example includes the loss of revenue suffered after substantial property damage closes a business while the owner completes repairs. The intention of a BI policy is to maintain the turnover of the business during the indemnity period following an insured incident so that it can resume trading at its anticipated pre loss trading level.

Source: coverwallet.com

Source: coverwallet.com

The specific language of your business interruption policy determines how much you can recover after a loss. Insurance brokers and accountants can support in collating original documents demonstrating aspects such as the lost. Your Business Interruption Insurance covers the income lost when you were closed totalling 55000. Affecting the business before or after the damage or which would have affected the business had the damage not occurred. Therefore it is disappointing to us that at the time of writing less than half of the businesses in Australia and New Zealand have any form of Interruption Insurance.

In business continuity is the baseline of success. The LMI RiskCoach Hazard Rating Index Graph for a Clothing Retailer RISC Code 4251 0030. Ensuring a business has the correct insurance to continue to trade irrespective of internal and external factors is absolutely key. A guide to business interruption insurance. Business owners thought they were covered for loss of income under the terms of their business interruption insurance policies.

Source: researchgate.net

Source: researchgate.net

A list of policies assessed by insurers as in principle capable of responding to Covid-19 as a result of the test case. The specific language of your business interruption policy determines how much you can recover after a loss. For example if fire damage shuts down a factory the business income coverage usually pays for lost income until the damage can be repaired and production can be restored. Claims -basis of settlement A Loss of income The insurance by this item is limited to loss of income due to. Thats because in almost all cases continuous revenue and cash flow without interruption is the lifeblood of SMEs.

Source: chubb.com

Source: chubb.com

Ensuring a business has the correct insurance to continue to trade irrespective of internal and external factors is absolutely key. Nearly all of the claims have been met with letters of rejection from insurance companies. Your Business Interruption Insurance covers the income lost when you were closed totalling 55000. A reduction in incomeand b increase in cost of working and the amount payable will be. 1 Collate information as you go.

Source: mdd.com

Source: mdd.com

Business interruption insurance is insurance coverage that replaces business income lost in a disaster. Claims -basis of settlement A Loss of income The insurance by this item is limited to loss of income due to. Business interruption BI insurance has developed to help the Insured regain their predicted pre-loss trading position. Business Interruption Coverage Grant We will pay for the actual loss of Business Income you sustain due to the necessary suspension of your operations during the period of restoration The suspension must be caused by direct physical loss of or damage to property at the described premises in the Declarations. Most commercial property insurance covers business income loss by adding an addendum to the primary policy.

Source: nsureinsurance.co.uk

Source: nsureinsurance.co.uk

The italicised terms are subject to definition as. Commercial property insurance may cover the. Landlord shall use its best efforts to effect such repairs promptly. Providing your business insurance policy. An example includes the loss of revenue suffered after substantial property damage closes a business while the owner completes repairs.

Source: irmi.com

Source: irmi.com

Because Dictiomatics business interruption. Landlord shall use its best efforts to effect such repairs promptly. An example includes the loss of revenue suffered after substantial property damage closes a business while the owner completes repairs. Nearly all of the claims have been met with letters of rejection from insurance companies. The LMI RiskCoach Hazard Rating Index Graph for a Clothing Retailer RISC Code 4251 0030.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title business interruption insurance claims examples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.