Your Book to tax reconciliation example images are ready in this website. Book to tax reconciliation example are a topic that is being searched for and liked by netizens now. You can Find and Download the Book to tax reconciliation example files here. Download all royalty-free images.

If you’re looking for book to tax reconciliation example pictures information linked to the book to tax reconciliation example keyword, you have come to the right blog. Our site always provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Book To Tax Reconciliation Example. Balance Sheets assets liabilities and equity and income statements should be. Income by being recognized. Shop now for the 2021 tax year. ABC Corporation a calendar year C corporation has Net loss for books at year-end of.

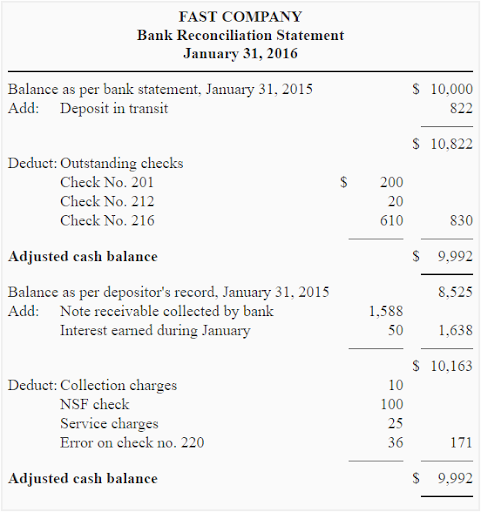

Sample Of A Company S Bank Reconciliation With Amounts Accountingcoach From accountingcoach.com

Sample Of A Company S Bank Reconciliation With Amounts Accountingcoach From accountingcoach.com

BOOK TO TAX RECONCILIATION. This creates discrepancies between the corporations general ledger and its tax filings. However tax returns must be completed based on the actual income received during the tax year. To Tax Reconciliation. Balance Sheets assets liabilities and equity and income statements should be. Shop now for the 2021 tax year.

BOOK TO TAX RECONCILIATION.

In Example 2 another company has one book-tax difference that is permanent. A book-to-tax reconciliation is the act of reconciling the net income on the books to the income reported on the tax return by adding and subtracting the non-tax items. Simplify your month-end close time consuming balance sheet reconciliations. Schedule M-2 Reconciliation With Line 11 Schedule M-3 Part I Line 11 must equal the amount shown on. Schedule M-1 Reconciliation of Income Loss per Books With Income per Return Tax Years 1996-1998 1 Net income loss per books after-tax Additions. Tax code 88888 should be adjusted for the book-to-tax difference in the Tax.

Source: pdfsimpli.com

Source: pdfsimpli.com

Accounting used on a companys audited financial statements. Schedule M-3 Book to Tax Adjustments. Accounting used on a companys audited financial statements. In Example 1 the company has one book-tax difference that is temporary in nature. To Tax Reconciliation.

Source: youtube.com

Source: youtube.com

View Homework Help - Scuba View Book to Tax Reconciliation Formatpdf from ACC 6210 at Utah Valley University. View Homework Help - Scuba View Book to Tax Reconciliation Formatpdf from ACC 6210 at Utah Valley University. A book-to-tax reconciliation is the act of reconciling the net income on the books to the income reported on the tax return by adding and subtracting the non-tax items. Balance Sheets assets liabilities and equity and income statements should be. In Example 1 the company has one book-tax difference that is temporary in nature.

Source: accountingclarified.com

Source: accountingclarified.com

Filed by all corporations filing Form 355 Form 355C. Schedule M-1 Reconciliation of Income Loss per Books With Income per Return Tax Years 1996-1998 1 Net income loss per books after-tax Additions. Common Book-Tax Differences on Schedule M-1 for Form 1120. View Homework Help - Scuba View Book to Tax Reconciliation Formatpdf from ACC 6210 at Utah Valley University. Ad How to speed up reconciliations w a checklist built by accountants for accountants.

Source: docs.oracle.com

Source: docs.oracle.com

This article provides an overview of an updated. Common book-to-tax differences understanding your business. Schedule M-3 Book to Tax Adjustments. Shop now for the 2021 tax year. Schedule M-2 Reconciliation With Line 11 Schedule M-3 Part I Line 11 must equal the amount shown on.

Source: qsstudy.com

Source: qsstudy.com

Shop now for the 2021 tax year. Schedule M-3 Book to Tax Adjustments. Common book-to-tax differences understanding your business. Tax code 88888 should be adjusted for the book-to-tax difference in the Tax. Simplify your month-end close time consuming balance sheet reconciliations.

Source: slideplayer.com

Source: slideplayer.com

Ad How to speed up reconciliations w a checklist built by accountants for accountants. Income by being recognized. In Example 1 the company has one book-tax difference that is temporary in nature. Please prepare the M-1 BookTax Reconciliation for the following example using the attached M-1 Schedule. Ad Tax research books that deliver.

Source: deskera.com

Source: deskera.com

Common book-to-tax differences understanding your business. Please prepare the M-1 BookTax Reconciliation for the following example using the attached M-1 Schedule. In Example 2 another company has one book-tax difference that is permanent. Simplify your month-end close time consuming balance sheet reconciliations. Ad How to speed up reconciliations w a checklist built by accountants for accountants.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Shop now for the 2021 tax year. Accounting used on a companys audited financial statements. And those S corporations filing Form 355S. Book to Tax Terms. Ad How to speed up reconciliations w a checklist built by accountants for accountants.

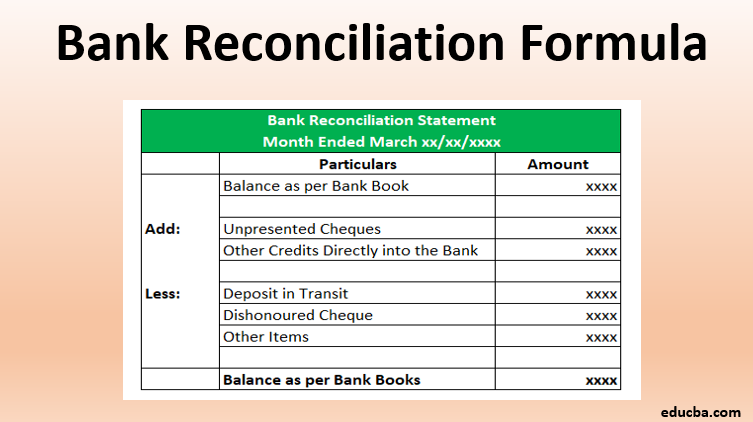

Source: educba.com

Source: educba.com

In Example 1 the company has one book-tax difference that is temporary in nature. To Tax Reconciliation. Schedule M-1 Reconciliation of Income Loss per Books With Income per Return Tax Years 1996-1998 1 Net income loss per books after-tax Additions. Shop now for the 2021 tax year. In Example 2 another company has one book-tax difference that is permanent.

Source: accountingcoach.com

Source: accountingcoach.com

Schedule M-1 Reconciliation of Income Loss per Books With Income per Return Tax Years 1996-1998 1 Net income loss per books after-tax Additions. Shop now for the 2021 tax year. In Example 2 another company has one book-tax difference that is permanent. ABC Corporation a calendar year C corporation has Net loss for books at year-end of. Filed by all corporations filing Form 355 Form 355C.

Source: simple-accounting.org

Source: simple-accounting.org

Income by being recognized. Schedule M-1 Book to Tax Reconciliation must be. Schedule M-1 Reconciliation of Income Loss per Books With Income per Return Tax Years 1996-1998 1 Net income loss per books after-tax Additions. Book to Tax Terms. Income by being recognized.

Source: thetaxadviser.com

Source: thetaxadviser.com

It follows that these 2 types are always a negative number on the reconciliation as shown in the depreciation example where we have an expense for tax but not book. The difference between book and tax depreciation leads some people to say Oh the company has two sets of books The fact is the company must 1 maintain depreciation records for the. It follows that these 2 types are always a negative number on the reconciliation as shown in the depreciation example where we have an expense for tax but not book. This article provides an overview of an updated. Accounting used on a companys audited financial statements.

Source: tallysolutions.com

Source: tallysolutions.com

While most business owners are concerned with the accounting impact for certain transactions they are. However tax returns must be completed based on the actual income received during the tax year. View Homework Help - Scuba View Book to Tax Reconciliation Formatpdf from ACC 6210 at Utah Valley University. This article provides an overview of an updated. Ad How to speed up reconciliations w a checklist built by accountants for accountants.

Source: pinterest.com

Source: pinterest.com

Estate Planning Under the 2017 Tax Reconciliation Act is a book addressing Tax Cuts and Jobs Acts. This creates discrepancies between the corporations general ledger and its tax filings. Simplify your month-end close time consuming balance sheet reconciliations. ABC Corporation a calendar year C corporation has Net loss for books at year-end of. Simplify your month-end close time consuming balance sheet reconciliations.

Source: slideplayer.com

Source: slideplayer.com

The difference between book and tax depreciation leads some people to say Oh the company has two sets of books The fact is the company must 1 maintain depreciation records for the. However tax returns must be completed based on the actual income received during the tax year. Estate Planning Under the 2017 Tax Reconciliation Act is a book addressing Tax Cuts and Jobs Acts. Ad How to speed up reconciliations w a checklist built by accountants for accountants. Schedule M-3 Book to Tax Adjustments.

Source: pinterest.com

Source: pinterest.com

This article provides an overview of an updated. Ad Tax research books that deliver. Common Book-Tax Differences on Schedule M-1 for Form 1120. In Example 1 the company has one book-tax difference that is temporary in nature. Reconciliation with data for Tax Years 19961998 1.

Source: educba.com

Source: educba.com

Common book-to-tax differences understanding your business. Common book-to-tax differences understanding your business. Accounting used on a companys audited financial statements. Schedule M-2 Reconciliation With Line 11 Schedule M-3 Part I Line 11 must equal the amount shown on. Estate Planning Under the 2017 Tax Reconciliation Act is a book addressing Tax Cuts and Jobs Acts.

Source: accountingcoach.com

Source: accountingcoach.com

Ad Tax research books that deliver. A book-to-tax reconciliation is the act of reconciling the net income on the books to the income reported on the tax return by adding and subtracting the non-tax items. Simplify your month-end close time consuming balance sheet reconciliations. Ad Tax research books that deliver. ABC Corporation a calendar year C corporation has Net loss for books at year-end of.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title book to tax reconciliation example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.